Have you ever imagined you could make a cash flow by renting a rental without buying a property? It sounds pretty crazy, right? But it’s possible with rental arbitrage. Having the option to benefit from land without really claiming any properties. Think about letting out a property for a more limited timeframe after leasing it out long haul for a higher charge.

Without an enormous initial expenditure, rental arbitrage can be an excellent way of earning money from real estate. We will be discussing more on what actually is rental arbitrage.

What Is Rental Arbitrage?

Rental arbitrage is a new investing strategy that has emerged to start a short rental business in the real estate industry. This is done when a property is leased long-term and consequently rented. Finding a property with a much higher short term rental rate than a long-term one is the way to a fruitful rental exchange. This is popular in areas popular for short-term rentals, including traveller areas of interest or well-liked resort areas.

The intention of people is to rent out their property through a manager and make money by charging higher rent to short-term renters than what they pay to the person who owns the land. This helps them make a profit.

What is the difference between rental arbitrage and subletting?

Rental arbitrage and subletting are methods for renting out a home, they may appear to be the same. People may believe that it is the same, however, there are some key differences. Long-term rentals are involved in subletting, while short-term rentals are involved in rental arbitrage. Renters can be many in rental arbitrage. However the owner finds subletting simpler because it entails long-term rents. As a result, there is only one renter.

Since the tenant is in charge of locating and screening potential short-term tenants, they often have more influence over the property in rental arbitrage. Although owners are still in charge of the property and the lease, the very first tenant usually has more authority while subletting.

If you like pets and want to keep them with you, you must ask for permission in rental arbitrage, while in subletting, approval is not required. Some people also like to set up a security camera for their safety, but you should ask for permission in rental arbitrage before keeping it. However, approval is not always needed when subletting.

Individual states have different laws governing subletting and rental arbitrage. Both of these actions are acceptable in various locales. There can be limitations on the length of time you can sublet a property in other regions. It is crucial to check the local legislation when doing so.

The Pros and Cons of Rental Arbitrage

We all know that everything has two sides, precisely like a coin, and everyone has a unique personality. Similarly, rental arbitrage has advantages and disadvantages, which we will discuss below. Before engaging in any business, it is essential to understand the benefits and drawbacks of the venture to make an informed decision.

Pros:

If you put in the effort, concentrate entirely on it, and control your risk surrounding it, rental arbitrage might be profitable. Following are some pros of rental arbitrage.

Potential for High Profit:

One of the most convincing benefits of rental exchange is the opportunity for a significant- profit. Finding a house you can lease for short of what you can rent will permit you to create a sizeable gain. However, it is essential to remember that this isn’t straightforward 100% of the time. Long haul and momentary rental rates could vary depending upon various factors, including the property’s area, kind, and season. Before you start, you should finish your work and ensure your examinations are related.

Low Upfront Cost:

One more advantage of rental exchange is that you can get going without possessing a house. By doing this, you can set aside a great deal of cash, as the need might have arisen to obtain a house. You should concoct an initial investment when you purchase a property, and this amount of cash can be sizable. Furthermore, you will be expected to pay shutting costs, which can cost many dollars. You can overlook these costs by participating in a leasing exchange.

Flexibility and Control:

The property and area choices accessible with the rental exchange are expensive. You can lease a property in any spot you like and suddenly switch the investment property. This can be a tremendous advantage to bring in cash from land without being focused on a specific property or area.

For example, to migrate for work, you can transient lease your current home until you track down another spot to dwell. On the other hand, if you need to put resources into land but don’t want to focus on buying a home, you could take a stab at leasing exchange.

Potential for massive Income:

Whenever you set up your rental exchange business, you can produce pay without dealing with the property effectively. This can be an extraordinary method for creating recurring, automated revenue, which is pay that you procure without having to work for it effectively. In any case, it is essential to note that you will have to invest energy to deal with the business, like finding and screening occupants, cleaning the property, and answering requests.

Cons:

It is vital to study all the drawbacks of rental arbitrage as well because if you do it ineffectively, there may be a greater chance of property damage. So that you can stay away from this and profit from rental arbitrage.

Risk of Property Damage:

Property damage is bound to happen when a rental property is leased momentarily than when it is leased for a drawn-out timeframe. It is because individuals who lease a spot for a short time are bound to be new to it and doubtful to deal with it. They could likewise be more inclined to have occasions or participate in different exercises that damage the property.

You might bring down this risk by carefully choosing your tenants and having them sign a damaging discharge. However, it’s pivotal to be aware of the gamble and set up a system in the event of damage. This can involve making an insurance buy or setting aside a damage instalment.

Tenant turnover:

This is due to the likelihood that short-term renters may enter and exit the rental home more often than usual. You should track down new tenants and clean them in the middle between leases, which might be tedious and costly.

Local Regulations:

Ensure you comply with all nearby regulations administering transient rentals. To forestall fines and different punishments is crucial. Research is fundamental because the guidelines can vary depending on where you are. There are restrictions on short-term rentals in specific urban communities and neighborhood states; for example, covers the number of days a home might be leased yearly. You could require a grant or permit to run a short-term rental.

Insurance:

To safeguard yourself from legitimate liability in case of mishap or property damage, you should secure insurance. Doing this is vital to guarantee that you are safeguarded in case of an unanticipated event. Any vital clinical expenses ought to likewise be covered by the insurance policy, alongside the expense of property fixes. Also, affirming that the insurance contract covers the rentals you give is pivotal. While some insurance policies exclusively cover long-term rentals, others also cover short-term and long-term lodging.

Using the land to produce pay through the rental exchange can find success. Before starting, it’s significant to consider the benefits and disadvantages thoroughly. Do the required research to fully understand the risk factors if you consider using this approach.

Also Read: Pros and cons of renting a house

How does Rental Arbitrage Work?

Rental arbitrage is a real estate investment in which you rent a property long-term and then lease it out on a short-term basis through Airbnb or VRBO. To get started with rental arbitrage, you should track down property in a desirable location and lawful to lease on a momentary premise. You will then, at that point, need to consent to a rent arrangement with the landowner and rundown the property on a short-term rental platform. When the property is reserved, you will gather the lease from the visitors and pay the landowner their month-to-month lease.

For example, imagine you sign a one-year lease for $2,000 each month on a reasonable one-bedroom condo or apartment in a well-known city. After that, put the place up for lease on Airbnb for $100 per night. If the apartment is rented for more than 15 nights, you will make $2000 in profit. You might create a benefit of a few hundred bucks consistently, even after deducting costs for cleaning, utilities, and taxes.

There are a couple of things to remember while doing a rental arbitrage. It would be best if you calculated the expense of cleaning and upkeep for the property. You may likewise have to settle inhabitance charges and different expenses. Second, you want to ensure you follow all neighborhood guidelines. Finally, you should be ready to deal with any unexpected problems.

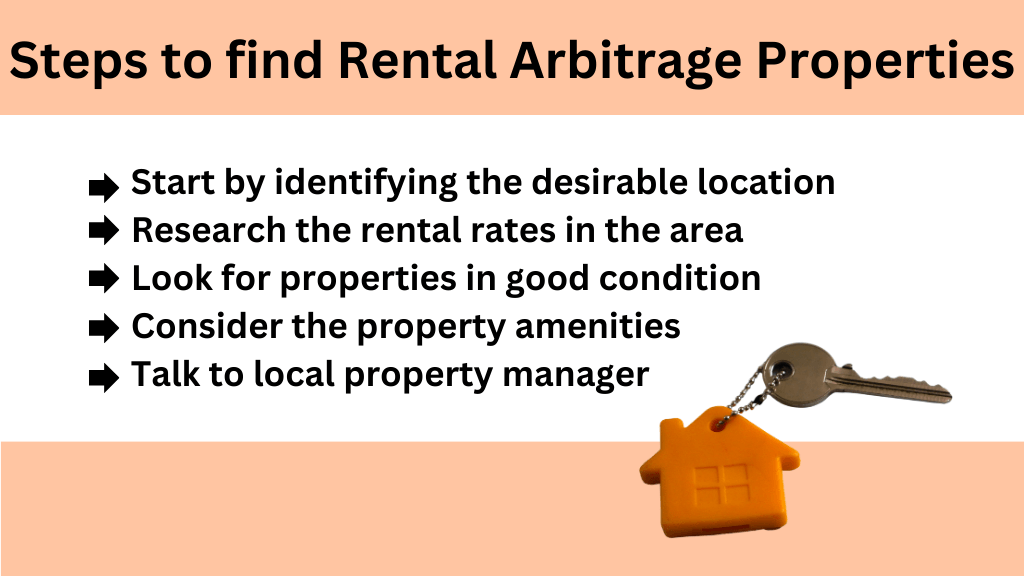

How to find rental arbitrage properties

Here are some tips on how to find rental arbitrage properties:

Start by Identifying Desirable Locations:

These are places, such as popular get-away locales or traveler areas of interest, with an appeal for momentary rentals. To determine which urban areas and neighbourhoods have the most listings, use web tools like Airbnb and VRBO.

Research the Rental Rates in the Area:

You can look at neighbourhood rental costs whenever you’ve restricted your inquiry to a few beneficial regions. It will help you determine how much the short-term and long-term rental rates differ enough.

Look for Properties in Good Condition:

Finding a property that is in great shape and easy to clean and keep up with is significant. It will simplify it to attract and keep short-term tenants.

Consider the Property’s Amenities:

Considering its conveniences while looking for rental exchange homes is vital. Properties with short-term tenants’ favored offices, such as a pool or hot tub, will likely lease quicker and for more cash.

Talk to Local Property Managers:

You can talk with adjacent property directors, assuming you know where to start. They could help you see a reasonable home and deal with the renting system for your benefit.

Is Rental Arbitrage Right for you?

Several factors determine whether or not Rental Arbitrage is right for you. As we all know, Rental arbitrage is a business, and the market is subject to change anytime. In any business, the money you have invested could be wasted, as well as a chance that you could receive more money in return. The same applies to rental arbitrage; you could lose money if a property does not rent as soon as possible.

The amount of money you will need to spend on cleaning and covering the cost of rent is also present, although it is a low-cost investment. Rental arbitrage is the best option if you are willing to invest the necessary time, effort, and resources. Additionally, check with your local authorities to see if this is permitted because, in some places, it is not. You should reconsider if you don’t have extra time or intend to carry out rental arbitrage during your downtime from work. You must put in much effort to get extra money because this business requires more time. Think twice before trying to execute rental arbitrage.

How Much Can You Make From Rental Arbitrage?

A few elements decide how much cash you can acquire through rental exchange:

The Property’s Area: Land in popular vacationer regions is commonly more productive than land in less appealing regions. For example, a property in Hawaii would likely find success than one in the Midwest.

Property Type: A few properties, such as occasion homes and lofts, are regularly leased on an impermanent premise than others. For example, a two-room condo would be more successful than a studio.

The Length of the Rental: The additional time the property is leased, the more cash you can make. For example, a home leased for 20 days out of each month will create more income than one leased for just 10 days of the month.

The Cost of Lease: Your overall revenues will be affected by how much lease you pay to your landowner. For example, a property with a $1,000 month-to-month lease will have more modest net revenues than a property with a $500 month-to-month lease.

The Expense of Extra Costs: Your overall revenues may likewise be affected by costs like those for cleaning, upkeep, and property on the board. Unlike a property with low cleaning and upkeep costs, a property with high cleaning and support costs will have lower net revenues.

The most productive rental exchange properties will regularly be those in notable traveller regions with high inhabitance rates and negligible functional expenses. But before deciding if rental arbitrage is the appropriate strategy for you, it’s crucial to conduct your homework and thoroughly weigh all relevant elements.

Also Read: How Much to Charge for Rent

What Landlords and Tenants Should Know

Here are some things that landlords and tenants should know about rental arbitrage:

Amending the Lease Agreement: It could be essential to change your rent understanding to allow your tenant to participate in the rental exchange. This is because of the way that most normal rent arrangements bar momentary leases. The subtleties of the rental exchange ought to be determined when you change the rent understanding, including how long the occupant can sublease the property, how much lease they should pay, and what the executives’ obligations they have.

Charges and Different Costs: As the property manager, you might be liable for paying duties on the pay produced from the short-term rental. You may likewise be answerable for paying different costs related to the rental, like utilities, insurance, and property management charges.

Responsibility for Harm: As the landowner, you might be obligated for any harm brought about by visitors to the property. This is valid regardless of whether the occupant has a security store. It is vital to have a decent comprehension of your risk before permitting your occupant to take part in the rental exchange.

Tenants:

Getting the Landowner’s Permission: To utilize the rental exchange, you should initially get the property manager’s permission. Asking before you start is fundamental since the property manager probably won’t be ready to allow you to participate in the rental exchange.

All Costs Connected with the short-term Rental: Like cleaning, upkeep, and visitor correspondences, will be your obligation as the tenant. Being prepared before you start is critical since this can include a significant measure of work.

Nearby Regulations: There might be regulations in your space that apply to short-term rentals. Getting your work done on the regulations in your space before you start is essential because these guidelines can vary from one city to another.

To ensure you are defended as a landowner, you should carefully look at your rent understanding and talk with a lawyer. If you’re a tenant considering utilizing rental exchange, you should look at the regulations in your space and ensure you’re prepared to deal with the property well.

Conclusion

In conclusion, rental Arbitrage might not be suitable for everyone. But if you travel to a foreign country and want to stay without any hassle, then Airbnb rental arbitrage might be a good choice.

I suggest contacting our OKC property management company for guidance if you consider engaging in rental Arbitrage. We can assist you in finding a home, maintaining the rental, and adhering to local laws because we have years of experience handling short-term rentals. Contact us immediately to learn more about how we can assist you with rental Arbitrage.

FAQs On Rental Arbitrage

Is Rental Arbitrage Legal?

Rental Arbitrage may or may not be allowed depending on local rules and legislation where you are doing business. Rental Arbitrage is generally acceptable if you have the landlord's consent and follow all applicable rules and laws.

Is rental Arbitrage always profitable?

No, rental Arbitrage is not always successful because this is a business, and the market constantly changes. You will make money and be profitable one day, but the next, you won't.

Is rental Arbitrage worth it?

Rental Arbitrage may be worthwhile if you're good at managing your time. Because you will focus all your attention on it, making it your primary business will help you determine whether it is worthwhile.

How risky is rental arbitrage?

Although it is understood that rental arbitrage is a business, the business fluctuates because of the unstable market, and we cannot control those circumstances. There is always a risk when conducting business, so you must always be ready for it.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(