Deciding the ideal place to live in can be difficult, especially while settling on leasing and buying. In the constant change of modern living, even the choice to lease a house is significant for people and families. While there are numerous things to consider before settling on an option, you shouldn’t forget that your capacity to spend cash will most significantly affect your decision.

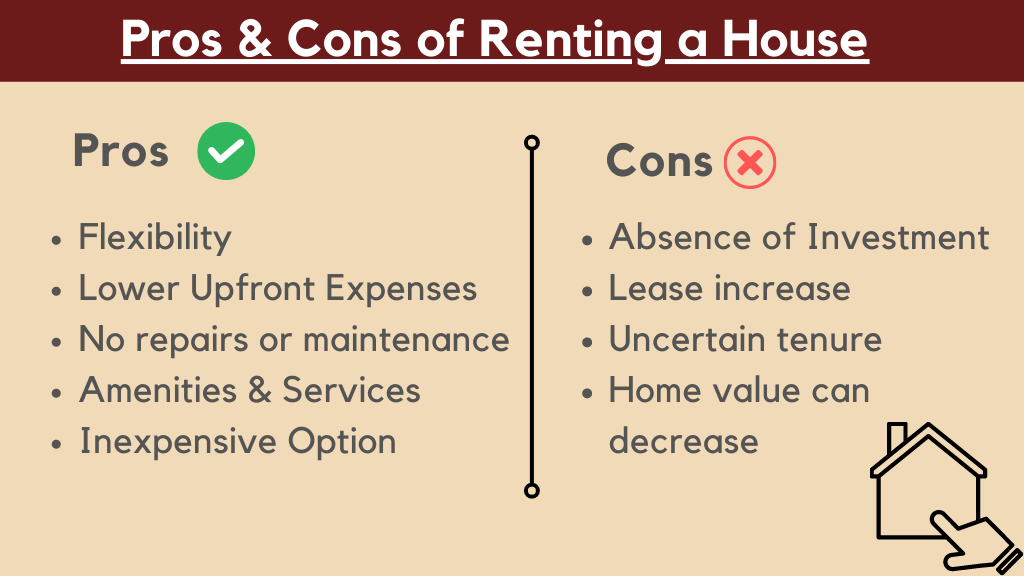

Before we decide, we should look at the pros and cons of renting a house since leasing has both positive and negative perspectives.

What are the Pros and Cons of Renting a House?

It is a well-known decision to rent a home for individuals and families. Leasing offers the opportunity to move without bearing the cost of selling a home and provides a more flexible way of life. We will discuss in detail the pros and cons of leasing a house to help you make a proficient decision about your lodging choices.

Few things to consider before you choose to rent a place. Here are the pros and cons of renting a home.

Pros of Renting a House:

An excellent option for you, if you are not considering home ownership, is to rent a house. Before making significant decisions, consider the pros of renting a home by reading the following full explanation.

Flexibility: Renting allows you to move whenever you need without the hassle of selling your home. This is an excellent or ideal option if you’re relocating for work or are still determining your long-term plans. Leasing offers the freedom to change your living situation when your lease ends.

Depending upon your preferences and financial crisis, you can choose from an assortment of renting choices. In a review directed in 2021, 45% of leaseholders expressed that the capacity to move about unreservedly was the fundamental consideration of their decision to rent. The National Association of Realtors (NAR) anticipates that American property holders stay in their homes on normal for a considerable length of time which is 13 years.

Lower Upfront Expenses: Leasing a house has a lower beginning expense than buying a home. You do not need to make an excessive initial instalment or stress over additional costs like local charges, home protection, or support. Leasing does not require an upfront instalment; lease instalments are ordinarily lower than contract instalments.

The middle down payment for a home in the US has expanded lately. In 2022, the middle upfront installment was more than $20,000. This implies that tenants can set aside sufficient cash by renting, as they will not need to make an initial installment. The typical initial investment for a house is around 20% of the price, according to The New York Times article. Then again, tenants regularly pay a security store and a little application expense.

No repairs or maintenance: Home maintenance and repair costs are covered by your landlord, which can be exceptionally financially wise for you. Those with fixed salaries or limited spending plans might view this consistency as supportive. You do not need to invest your energy in finding and planning with workers by having the property manager handle fixes and upkeep. This saves you time and energy to give to different aspects of your life and decreases the pressure from home upkeep tasks.

According to HomeAdvisor, homeowners spend an average of more than $3,000 on home repairs. By renting, you can save significantly since your landlord is responsible for maintenance and repairs. As per industry estimations, property holders’ yearly support costs will probably go from 1% to 3% of the worth of their homes in the coming future.

Amenities & Services: Commuting amenities like communal areas, gyms, or pools in a few rental homes can improve your quality of life without including your costs or adding to your work. Access to amenities that would otherwise be highly costly is one of the advantages of renting a home.

60 percent of rental homes in 2022 will have services and amenities like gyms, swimming pools, and laundry facilities. In future, an increase in this number is expected.

Inexpensive option: Since leasing empowers you to live within your means, it is more affordable and accessible. You don’t need to focus on a long extend and can move to a more reasonable home anytime. Moreover, there is no action that you will not be able to make contract instalments or face cost variances.

The commonplace lease for a one-room condo in the US is under $15,000. Normally, this is more sensible than the middle home credit segment, which is under $2,000 each month.

Here take a look at things that a landlord cannot do while renting out

Cons of Renting a House:

As is common knowledge, everything has advantages and disadvantages, and renting a home is no different. People considering renting a house may change their minds by being aware of the drawbacks. Therefore, the following are the cons of renting a home. Think about it before renting a home.

Absence of investment: If you rent a home, you do not build equity. Your month-to-month lease doesn’t add to your drawn-out monetary dependability; instead, you support another person’s venture.

60% of tenants said they were stressed over not expanding value by renting, as indicated by a 2022 study by Run-down apartment. This number has expanded to 70%, as per a Apartment List from 2023.

Lease increase: Lease increments can occur whenever planning is challenging. If your rent is renewed, the landowner might raise the monthly rent payment at their drive. These changes might affect your spending plan and long-haul monetary arrangement.

In the US, the commonplace lease increment for 2022 was 10%. Tenants may in this way experience an expansion in lease of around $100 each month. In the US, a 10-15% typical lease increment is expected in coming years.

Leaseholders could in this way hope to see a typical expansion in lease of $100-150 every month. As per a recent report by Zillow, the typical lease expansion in the US during the primary quarter of that year was 12.4%. You can also utilize our rent affordability calculator to help you balance your income and rent with other living expenses.

Uncertain Tenure: Leasing offers adaptability. However, it implies that your occupancy relies on the property manager’s judgment. They could choose not to expand their rent, making tracking down another spot to live in unpleasant. The commonplace rent term in the US is one year. As such, regardless of whether a tenant needs to remain in similar spot, they may be approached to leave when their rent lapses.

In the US, a rent commonly has a year term. There are, nonetheless, bits of rumor that a few property managers are starting to give more limited rent terms, similar to 6 or 9 months.

Afterwards, tenants may be approached to leave their homes all the more much of the time, which can make it trying to track down a steady spot to reside. As per a RentCafe study from 2023, how much lofts with rent terms of a half year or less rose from 10% in 2022 to 15% in 2023.

Home value can decrease: No such thing stays the same as always. Similarly, the price of a home can drop because it has been consistent for so long that the market rates or price varies from time to time. Decreasing the value of the house can harm you later in your finances.

In 2022, there was a 3.4% decrease in the middle home estimation in the US. As needs be, occupants who bought a home in 2022 could have experienced a misfortune on their purchase.

Your ideal decision will rely upon your specific circumstance; no set-in-stone reaction exists. While deciding if leasing a house is a perfect choice, it is vital to consider your one-of-a-kind possibility and needs cautiously. Leasing rental property, rather than buying a home, is, at last, an individual decision.

Recommended: Rental Management Fees in Property Management OKC

Renting vs. Buying a Home: Which is Better?

Money is the main thing that rings a bell before following through with something or settling on a lease agreement or decision. There is a perception that buying is a “venture”, while leasing is viewed as “discarding cash.” The decision is generally yours before choosing whether to purchase a home or lease one. The initial step is to ask yourself, “What will be better for me concerning what is going on?”

Renting a house gives adaptability, no direct upkeep expenses, and lower month-to-month costs. For people who travel around a lot, leasing is a better option than buying, which is usually an extended investment. But remember that renting a house means you cannot make any changes according to your wish while a renter. One of the advantages is that the landowner is responsible for insurance on support and fixes, local charges, HOA expenses, and different expenses.

Meanwhile, buying a home offers security, likely appreciation, and the opportunity to customize your home. Additionally, the monthly mortgage payment includes not only the mortgage itself but also property taxes, insurance, and other fees. Owning a home means you can make any changes to your property, like decor and making it more stylish. You do not have to worry about being blamed for what you have not done because sometimes landlords are more annoying and unsatisfied with many things. As a homeowner, you’re liable for upkeep and fixes, which can add to homeownership costs. Moreover, mortgage interest deductions can lead to significant tax savings each year.

Claiming a house is an investment, and like all, the venture can go up or down in esteem and may harm your finances later. If you want to put resources into the long haul, you can purchase a home instead of leasing one. Be that as it may, if your financial status is poor and you can not deal with credits, you should stay with renting. The obligations of leaseholders and property managers are unique. Property owners might profit from charge allowances they pay, for example, contract interest and local charges, which can lessen their general taxation rate. Leaseholders don’t approach these allowances.

People who rent a home against those who own one is the comparison in the data from 2019 to 2023. We can see that the rate of rentership has been falling. In a similar time span, the homeownership rate in the US is increasing since 2019. This is due to various factors , for example rising property costs, loan obligation and so on.

Is It Better Financially to Rent or Buy a House?

Deciding whether to rent or buy a house financially depends on your personal situation and market conditions. Renting involves lower upfront costs and offers flexibility, as well as no maintenance responsibilities, but does not build equity. Conversely, buying a home allows you to build equity and provides stability, along with potential tax benefits, but requires a significant down payment and comes with maintenance responsibilities. Ultimately, if you plan to stay long-term and can afford it, buying may be advantageous; if you seek flexibility or are unsure of your future, renting might be the better choice.

You might want to know about Can a Landlord Make a Tenant Pay for Repairs

Conclusion: Is Renting a House Worth it?

There are many pros & cons of renting a home, as we can see that. Depending on conditions and inclinations, leasing a house can be worthwhile for some people. There are a few benefits to leasing, like adaptability and opportunity. Except if you have a complete handle on landowner inhabitant regulations or have a lot of spare energy, employing an expert property manager is ideal. Leasing investment property likewise frees you from the obligations and expenses of property upkeep and fixes.

Our authorized OKC property managers will guarantee your property is overseen as ours by Your okc property manager. Contact us today by calling 14052325800 or filling up the form.

FAQs on Pros and Cons of Renting a House

Does renting ever make more sense than buying?

The solution to this question relies on your decision, financial status, and needs. If you want a drawn-out venture, you can purchase a home rather than leasing one, as building equity through mortgage payments can provide significant financial benefits over time. Specific individuals have various considerations for buying instead of renting a home.

Is it better to lease or own a home?

If you are uncertain where you wiil be in the following 2 years, renting is a superior choice. There is no authoritative response to this because numerous things like finance and way of life rely on people. Additionally, the long-term financial commitments associated with a mortgage loan, including hidden costs and significant upfront expenses, which can deter you if you are not prepared to handle such obligations.

Is renting cheaper than owning a house?

Whether renting is cheaper than owning a house depends on location, long-term plans, and housing market conditions. Renting provides more flexibility in moving to a different location or downsizing without the hassle of selling a property, and it often results in lower monthly payments compared to the unpredictable costs associated with homeownership, such as property taxes and maintenance.

Is ownership a good investment to build equity?

Land can increase the property value over the long run, giving mortgage holders a significant resource. Possessing a home likewise gives solidness and the opportunity to tweak the space as you would prefer. In any case, it’s essential to consider the costs connected with homeownership, including contract installments, local charges, upkeep, and protection. The market condition, the region, and how long you plan to remain in the home immensely affect how productive a venture house buying is for you.

What’s the best way to rent a house?

Beginning with research is the ideal way to lease a house. Recognize your desired area, financial and mortgage payment plan, and understand the implications of rent payments. You can use online stages and realtors for more information.

Are there any tax benefits to renting?

While renters do not receive the same tax benefits as homeowners, some rental expenses may be deductible if you operate a home office or for specific job-related relocations.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(