Curious about how much property managers charge? Wondering what leasing fees and property management fees look like in the OKC Metro area? You’re in the right place! This guide will walk you through everything you need to know about property management costs, including the fees charged by my company, OKC Home Realty Services, LLC.

Searching for property management services shouldn’t feel like a treasure hunt. Think about it: when you shop online on platforms like Amazon, you expect to see prices upfront, right? Yet, when you visit the websites of Oklahoma City property management companies, pricing often feels like a well-kept secret. Why is that? Why force you to contact someone just to get basic price information? This might be one of the factors influencing property management costs.

If you’ve been frustrated trying to dig up these details, don’t worry; we’ve got you covered. Keep reading, and we’ll break down these fees and help demystify the costs so you can make informed decisions.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →Key Takeaways

Monthly Management Fee: Usually 8.5–10% nationwide; in OKC, it’s closer to 8–12%. OKC Home Realty charges 10% of rent collected.

Leasing/Placement Fee: Ranges from $200 to a full month’s rent; OKC Home Realty charges ½ month’s rent and includes a tenant guarantee.

Other Common Fees: May include maintenance coordination, advertising, late rent collection, eviction handling, lease renewals, and accounting.

Fee Collection: Most fees are deducted directly from rent before owners receive payouts and should be detailed in the management agreement.

Value of Professional Management: Property managers help reduce vacancies, handle tenant issues, ensure legal compliance, and save landlords time.

Local Insight: The article highlights Oklahoma City rates and compares them with OKC Home Realty’s transparent fee structure.

How Property Management Fees Work & Typical Cost Structure?

Property management fees are charges that property owners pay to professional property management companies or individuals in exchange for the management and upkeep of their real estate assets. These fees cover a range of services to maximize the property’s value and generate rental income. Here’s how property management fees generally work:

1. Types of Fees: Property management fees can vary based on the property type (residential, commercial, industrial), location, and the extent of services provided. The two main types of property management fees are:

a). Monthly Management Fee: This is a percentage of the monthly rental income collected from tenants. On average, property management fees range from 8% to 12%, with the national average falling around 8.5% to 10%. In some luxury or high-demand markets, rates can dip as low as 5–6%, while in smaller markets or for high-maintenance properties, they may climb to 12–15%. The exact percentage depends on the property’s location, size, and the level of services included in the management agreement.

b). Leasing/Placement Fee: A tenant placement fee is charged when the property management firm finds a new tenant for a vacant property. It’s usually a one-time fee equivalent to one month’s rent or a fixed amount.

2. Additional Fees: Property owners may incur other charges for specific services besides essential management and leasing fees. These might include:

a). Maintenance and Repair Fees: Property managers may charge for overseeing repairs and maintenance tasks. Some companies have in-house maintenance teams, while others contract the work out to third-party vendors.

Related Article: Do property managers pay for repairs?

b). Advertising Fees: These fees cover the cost of advertising the property, including listing it on rental websites and conducting marketing campaigns.

c). Late Payment Fees: Property managers may charge a fee if a tenant pays rent late, which can serve as an additional revenue stream.

d). Eviction Fees: If an eviction process becomes necessary, property management companies might charge fees for handling legal proceedings.

e). Accounting and Reporting Fees: Property management companies often provide financial reports and statements to property owners, and there might be fees associated with this service.

f). Lease Renewal Fees: Some property management agreements stipulate a fee for renewing a tenant’s lease.

3. Contractual Agreements: The cost of property management fees is generally outlined in a property management contract between the property owner and the management company. The agreement will detail the scope of services, the costs associated with each service, and any terms and conditions.

4. Collection and Payment: Property management fees are usually deducted from the collected rental income before the remainder is sent to the owner. For example, if the monthly rental income is $1,000 and the management fee is 8%, the property owner would receive $920 after the fee deduction.

5. Choosing a Property Management Company: When selecting a property management firm, it’s important to carefully review the fee structure, understand what services are included in each fee, and determine whether the fees align with landlord-tenant laws and Federal Fair Housing laws. Cheaper fees might not always translate to better service, so assessing the company’s track record, reputation, and reviews from other property owners is essential.

How Much are Leasing Fees and Property Management Fees?

For the most part, there are only two administrative fees for property management services. Anyone who tries to make it more complicated is putting up smoke screens. Most rental management companies charge a fee for locating and placing a new tenant, called a leasing fee. And also property management fees for the day-to-day aspects of managing your property.

The fees charged by the property management company for the day-to-day operations of the property include collecting rent, following up on items such as maintenance, and providing an accounting report to the owner.

In addition, residential property managers should be the interface between the tenant and the owner. The property manager needs to set up and take care of maintenance and repairs, handle collections of monthly rent, and other tasks that are related to the property or tenant issues.

Recommended Article: What is included in Property Management Contract?

Leasing Fees: Ranges from $200 to the First Month of Rent

Property managers charge the leasing fee for the rental of the property, whether it is managed by a property management company or by the owner. It consists of a tenant placement fee. The property management cost applies to all the work involved in the rental property. This property management fee includes showing the property, screening all applicants, and finding a good tenant who will be approved.

Some rental property managers charge a low flat fee, while some may ask for up to one full month of rent. The ones that charge the low fee may try to make up for it with other administrative fees, so find out any other miscellaneous fees that you will be charged, such as releasing or lease preparation.

My company, OKC Home Realty Services, charges ½ of the first month of rent to locate a new tenant for the rental property. This fee covers all advertising and marketing costs, showings, taking and securing applications, and preparing the lease. We also provide a tenant placement guarantee, so if they move out before the end of the lease period, we replace the tenant at no additional tenant replacement fee (that is, no extra management costs). We can make that strong guarantee because we do a thorough job screening the tenant. In addition, we DO NOT charge a release fee.

Also Read: What landlords should know about multiple tenant lease agreements?

Property Management Fees: Generally 8% to 12% of the Total Rent

The property management fee is the fee for the day-to-day management of your rental property, such as collecting and processing rents, communicating with tenants, coordinating maintenance and repairs, responding to emergency maintenance calls, and providing the accounting for the properties in the form of itemized monthly statements.

Property managers mainly charge between 8% to 12% of the gross rent monthly for their property management service. If your rent is $1,000 monthly, you will pay the property manager between $80 and $120 monthly in management fees.

OKC Home Realty Services charges a property management fee of 10% of the rent with a maximum of $100 per month. For that, we take care of collecting the rent, taking and handling requests from tenants and rental property owners, coordinating the maintenance, and providing the account (i.e., itemized monthly statements). In addition, we provide a year-end statement for property owners to provide to their accountants for income tax purposes.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →How Much Does a Property Management Company Charge?

Here are some of the property management fees that I know some other property management companies are charging. Also, know how much property managers make.

| Types of Fees | Other Companies Charge | OKC Home Realty Services |

| Releasing Fee | ½ to 1 full month Rent | $0 |

| Lease Processing Fee | $200 to the owner on top of the leasing fee charged to the owner | $0 |

| Late Fee | Property management Company keeps most or all of the late fees | $0 |

| Maintenance Fee | $60 to $80 an hour | $35 per hour average |

| Setup Fee | $500 | $0 |

- Also, some lock you into annual contracts that you just can’t get out of until the contract expires.

- Releasing fee – ½ to 1 full month of rent. This is a tenant signing up for another 12 months. NOT a new tenant.

- Lease processing fee – $200 to the owner on top of the leasing fee charged to the owner. This is in addition to the leasing fee.

- The management company keeps 100% of the late fees from the tenant. That’s right, they don’t pay anything to the owner.

- Charging their technicians $60 to $80 per hour for tasks as simple as repairing a toilet.

- Setup fees, some as high as $500.

As you can see in the table above, OKC Home Realty Services charges nothing for releasing, late fees, or setup fees. And our average charge for maintenance is $35 per hour.

Check out our OKC Home Realty Services’ property management pricing for property management costs.

Other hidden fees you need to ask a prospective property management company about include if they charge extra administrative fees for bookkeeping, doing evictions (representation in court), and/or up-charges on maintenance expenses. OKC Home Realty Services does not charge for those services, either.

Some property management companies charge the rent upfront for one month, and you may need to pay this fee when hiring a property manager while the rental property is vacant. OKC Home Realty Services does charge you for a vacant property.

Factors That Affect Cost of Property Management Fees

Several factors can influence property management fees. These factors include:

Property Size and Type: The size and type of property being managed, such as single-family homes, multi-unit buildings, or commercial properties, influence the complexity of management and associated fees.

Location: The location of the property impacts fees associated with the management. Properties located in places with high demand and higher market value may charge higher fees.

Services Provided: The range of services provided by the property management company influences the management fees. Services like screening tenants, coordinating maintenance work, and reporting on financial status add more to total fees.

Property Condition: The condition of the property and the level of maintenance needed influence charges. A damaged property may need more regular attention to keep it in good shape and hence incur lower fees.

Number of Units: The number of units to be managed influences the fee structure. Managing many units almost involves a lot of administrative work, which inflates costs, leading to higher fees.

Market Factors: Local conditions like supply and demand dynamics, prevailing rental rates, and others play a role in incurring the fees for a property.

Company Reputation/Expertise: Company reputation, experience, and expertise affect the fees charged. Well-established and reputable management companies have better records of achievement and command maximum fees.

These are some of the factors that individual property management companies across various locations deal with. It’s advisable to consider these factors with other potential companies before finalizing a choice.

What Services Are Included in Property Management Fees?

In truth, the property management fees charged by reputable property management companies are not that much different.

Are your rental properties becoming too much to handle? Here is a solution if you have never had a property manager.

You are paying the property management company’s systems.

Here’s where experience comes into play. What systems does that company have in place to keep the rental payments coming in, keep costs down, and communicate to you what’s going on?

Every day we are in business, we learn something new. That means we improve every day.

You are paying for the property management company’s integrity.

Will they tell you the truth, even when they screw up?

We make mistakes sometimes. It’s not easy to admit when you did something wrong, but I’d rather admit I made a mistake and move on because it’s better for everyone involved. Every rental property manager makes mistakes. What matters is how the property management company deals with them when issues arise.

You are paying for the property management company’s experience.

Some real estate companies can do everything across a broad spectrum of services all across the state. And do a good job at most of them.

As a company, we’ve never done well trying to be the right solution for every need. The problem is that you never get really good at anything. That’s why we focus on providing a high-quality residential property management service for single-family homes and small apartment properties in the OKC metro area.

What is the most difficult part of self-managing a property?

Screening Tenants can be a difficult task if you do it right (credit checks, calling references). Plus, there’s a fair chance you’ll inevitably have to deal with an unfair tenant, late rent, or eviction, even if you screen your tenants well. Also, if you want to rent a property management company, you have to deal with lots of issues. Great, if you feel like you’re well prepared to deal with this stuff.

How to Compare Property Management Services & Fees

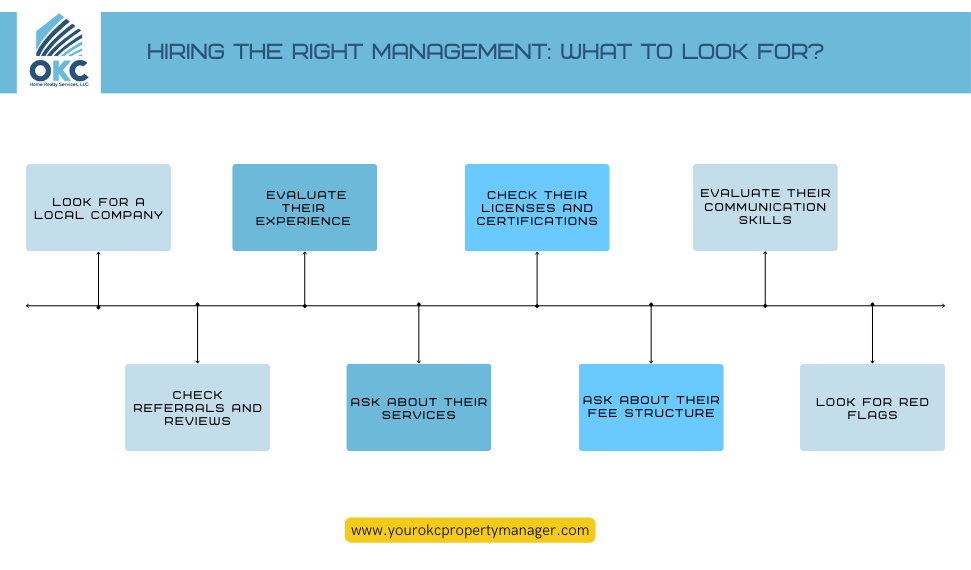

When hiring a professional property manager, you must be ensured you choose the right one by considering several factors. Here are some tips to help you choose the right property management company that enables you to maximize your investment:

Look for a Local Company: Choose a property management company near your property, as they will better understand the local market and laws.

Check Referrals and Reviews: Ask for referrals from other property owners or check online reviews to get an idea of the company’s reputation.

Evaluate their Experience: Ask about the company’s experience managing properties similar to yours and how long they have been in business.

Ask about their Services: Inquire about their services, such as tenant screening, rent collection, maintenance and repairs, and legal compliance.

Check their Licenses and Certifications: Verify that the company is licensed and has any necessary credentials to operate in your area.

Ask about their Fee Structure: Inquire about their management fee and any additional fees they charge, such as setup fees, leasing fees, and maintenance fees.

Evaluate their Communication Skills: Ensure the company is responsive when dealing with them.

Look for Red Flags: Watch out for red flags such as disorganization, low occupancy rates, bad reviews, and high costs.

Also Read: Property Managers Duties and Responsibilities

Is Hiring A Property Manager Worth the Cost?

If you are hiring a property manager, then you might also want to know how much property managers make per hour. An associate of mine once said that property management costs $25 per hour of work. Why does it cost that much? If you only own one or a few properties, you definitely need a property management company.

Hiring a professional property manager for $100 per month is worth it because you won’t need to worry about collecting rent, getting your paperwork right, being able to set up a maintenance call (at a reasonable price), and getting all your paperwork together for the taxman. And if something goes wrong, like you put the wrong person on the property because you did the screening or your family member stopped paying rent, you will kick yourself for not hiring a property management company.

There is also an emotional cost to being a property owner or property manager. You have to deal with upset tenants. If you can move quickly enough to fix their problem, they get even more upset.

Recommended Article: Pros and Cons of Hiring a Property Management Company

Conclusion on Property Management Rates

Property management fees are influenced by various factors, such as property type, location, services offered, etc. With a better understanding of property management cost breakdown, you can make an informed decision for hiring a property manager. Remember to consider their value regarding time savings, property maintenance, and tenant satisfaction. So, if you’ve been wondering, “How much do property managers charge?” now you know how to navigate this aspect of property ownership confidently.

Call us, property management OKC, today for a free property management consultation. Do what you do best and let the professionals do the same.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →FAQs on Property Management Fees

What percentage do property managers charge during a rental process?

Property managers typically charge a monthly fee between 9% to 12% of the monthly rent collected during the rental process.

Does Property Management OKC ask for any setup fees?

No. OKC Home Realty Services does not ask for any setup fees.

How much leasing fees do property managers charge?

Property managers can charge leasing fees ranging from $200 to first month of rent in Oklahoma

How time-consuming is it to manage a property?

Managing a rental property can be a time-consuming business activity. Performing activities such as finding tenants, tenant screening, regular inspections, dealing with repairs and maintenance, and other aspects of managing properties can take a lot of time, especially if you own several rental properties. Self Managing is not referred to as you are not capable of dedicating dedicated time to rental property management.

Are property management fees tax-deductible?

Absolutely! Property management fees are tax-deductible as operating expenses for your rental property. Learn more about the rental property tax benefits.

Do property managers offer guarantees on tenant quality?

Some property managers offer tenant quality guarantees, meaning they will cover eviction costs if a tenant they placed needs to be evicted within a specific timeframe.

Is it worth paying for property management?

Property management fees are an investment in protecting the value of your property, ensuring tenant satisfaction, and saving up your time for other works.

What is a reasonable management fee?

A reasonable management fee can vary depending on the type of investment or service being provided, but generally, it should be competitive within the industry while also reflecting the value and expertise of the management team.

What should I do if I’m unhappy with my property management company?

If you’re dissatisfied with your property manager, review your agreement for termination clauses as it's a legally binding contract, document your concerns, and consider discussing issues directly with the management company or you can terminate the property management agreement directly.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(