The application of knowledge is power, and your itemized statement is your most critical knowledge. As a property owner, you need to have up-to-date financial information on your rental properties.

It’s up to the property management company to provide that information. Not having itemized bank statements is like walking through a house of mirrors. You do see a reflection of yourself, but some of the mirrors are curved. Some show you as grotesquely thin or fat depending upon how the mirrors are misshaped. In order to get an accurate visual representation of yourself, you need to look at a mirror that isn’t warped.

In order to get an accurate financial representation of your rental properties, you need to get accurate statements that show all the income and expense information. Well, you might want to know, how to prepare Property Management Financial Statements

This article shows you what information is critical to make sure you are getting an accurate picture of what is going on financially with your rental properties.

Monthly Itemized Statement

For starters, you must receive monthly itemized statements every single month. That’s why they call it monthly.

One owner who recently hired my company to manage their properties told me they never received any type of itemized statements from her management company.

Big red flag. The first question that comes to mind is if that company was stealing from her. Clearly, she didn’t have any way to know.

Preparing monthly statements is one of the most time-consuming tasks that we perform for our clients. It takes several people working days straight to get this done. But it’s absolutely essential.

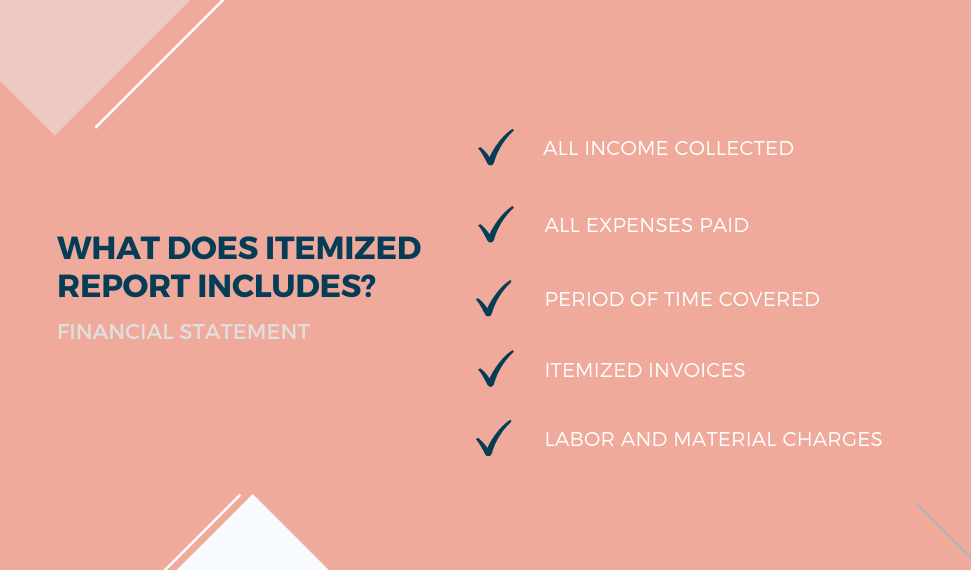

What is Included in Itemized Statement?

- Your monthly report should clearly state the period covered, all income collected, all expenses paid, and the specific OKC rental properties in question.

- You should receive copies of itemized invoices that provide a clear breakdown of what was done, and how much was charged for labor and materials.

You should be receiving those monthly statements at roughly the same time every month. The cut-off date for our statements is the 10th of the month. That means any income and expense items from the 11th of the prior month to the 10th of the current month.

OKC Home Realty Services send an email to our clients between the 12th and 14th of the month that has a copy of their statement. At the same time, we direct deposit their rent to the bank account they have provided to us.

Guidelines to Itemized Statement

No matter who is managing your properties, those itemized statements should come to you like clockwork every single month. In addition, you should have a clear expectation from your manager as to when the itemized report will be provided.

The management company should send rent to the owner at the same time as the monthly itemized statement is delivered. Your property management company should make direct deposits of the rent into your bank account to avoid any delays in getting your funds.

Annual Itemized Statement

You should also receive an annual statement corresponding to your tax year calendar from your property management company.

It should tabulate all income and expenses on a per-property basis for the calendar year. That way, you can provide this statement directly to your tax accountant. You will not have to go through all your monthly itemized statements and add things up yourself, which would be a pain.

Because we keep all of our client’s financial information for each property in a financial database, it’s easy for us to create a simple profit and loss statement for the year for each of our clients. You can simply hand that report to your accountant to prepare your taxes for the year.

Why is Financial Data Important?

Your property management company should definitely be keeping all of your information in some sort of financial database.

I’ll give you a perfect itemized statement example of why it is necessary to record all data safely.

We had a client contact us for all of his information for 2013. At the date of this writing, that’s five years ago. He needed the information to present to the IRS. Because we had all of his information in our database from day one, it was very easy to send him reports for every single month of that year. And, the income matched to the penny with 1099 we sent him for that year.

Note: How much do property management companies charge

Property Management OKC Maintains Financial Records

Whether managing rental properties or providing property management services, it is crucial to maintain proper financial records.

For example, it’s very unlikely the person who handles leasing is going to be the best one to answer questions about something on your statement.

What if you can’t wait for the monthly itemized statement?

For my clients who want access to their financial information 24/7, we have our client portal. It has any information that we have input into our database. So if you are wondering if the rent got paid yet for your property, you can just go to the portal to check it out.

If you have questions regarding financial statements and itemized reports. Contact OKC Property Management Company. Call us today.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(