Dealing with a tenant not paying rent is one of the most frustrating challenges landlords face. It disrupts your cash flow, creates uncertainty, and can strain your relationship with the tenant. Whether you manage a single property or an entire rental portfolio, rent arrears can quickly turn into a financial and legal burden if you don’t address them properly.

As a property manager, I’ve helped countless landlords navigate the delicate balance between protecting rental income and respecting tenant rights. While exact 2023–2024 delinquency rates aren’t available, a 2024 Apartment List report found that 1 in 5 renters struggled to pay rent on time at least once, suggesting possible delinquency rates of 10–20% in some markets, especially in high-cost areas. So if you’re dealing with this situation, you’re not alone, and you’re right to seek practical, effective guidance.

In this article, I’ll discuss what to do if a tenant does not pay rent. With over 15 years of experience in rental property management, I’ll explain every step, from identifying when rent is officially late to offering payment plans, and when necessary, pursuing legal action such as eviction or credit reporting. Let’s make sure you’re prepared to handle non-payment issues with professionalism, confidence, and legal clarity.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →When is Rent Considered Late

In many cases, rent is considered late after the specified due date specified in the lease agreement. This date is typically the first of the month, but this can change depending on the agreement.

Here are the points for landlords to know when is rent considered late:

No Grace Period: If the lease doesn’t mention a grace period, rent is technically late the moment it’s not received by the due date.

Grace Period: Many leases offer a grace period, allowing a few extra days (commonly 3-7) after the rent due date. During this time, the tenant can pay the rent without facing late fees or penalties. It is officially late if the rent is not paid within this grace period. Thus, explore rent grace periods and understand their benefits, typical durations, and how they enhance tenant-landlord relationships.

Weekends and Holidays: If the due date falls on a weekend or holiday, it usually gets pushed to the next business day. Your lease might not explicitly state this, but it’s a common practice.

When Payment is Received: Even if lessee pay on time, it might not be considered received on time if it takes longer for the landlord to process it. Electronic payments are primarily instant, but cheques or money orders might take another day.

What to Do if a Tenant Doesn’t Pay Rent

While encountering a tenant who doesn’t pay rent can be frustrating, it’s crucial to remember that following a structured and legal approach is vital to resolving the situation effectively and protecting your rights. Here’s a step-by-step guide on what to do:

1. Review the Lease Agreement: Go through the lease agreement to understand the terms regarding rent payments, late fees, and the procedure for handling late payments or non-payment. This will guide your actions and ensure they are in accordance with the contract signed by both parties.

2. Communicate with the Tenant: Attempt to contact the tenant to discuss the missed payment. They may have encountered temporary financial difficulties or overlooked the due date. A simple conversation leads to a mutual understanding or arrangement. Maintain a professional and respectful tone during the conversation.

3. Send a Formal Rent Demand Notice: If the tenant does not respond or rent remains unpaid, send a formal rent demand notice. This notice should clearly state the amount owed, the due date, and applicable late fees or penalties. This type of formal communication is often referred to as a late rent notice, and it documents the landlord’s efforts to resolve the issue before legal action is taken. Specify a deadline for payment and inform the tenant of the consequences of non-compliance. Thus, it’s best to know how you can collect unpaid rent after tenant moves out to recover your rental financial loss.

4. Offer Payment Arrangements: Depending on the tenant’s situation, consider discussing a payment plan that allows them to catch up on the rent over some time. This can be an excellent way to maintain a positive landlord-tenant relationship while ensuring the rent is paid. Any payment plan should be documented in writing.

5. Issue a Pay-or-Quit Notice: If the tenant still hasn’t paid the rent after receiving the demand notice within the specified time frame, issue a pay-or-quit notice, also known as a notice to vacate. This legal notice gives the tenant a final opportunity to pay the rent or face eviction. It is important to follow local laws and consider applicable tenant rights when preparing this notice, as they vary from one location to another.

6. Begin the Eviction Process: If the tenant does not pay the rent or vacate the property after receiving the pay-or-quit notice, file an eviction lawsuit in your local court that handles landlord-tenant/housing issues. It’s important to follow the correct legal process to protect your rights as a landlord. The eviction process involves:

- Filing an eviction notice with your local court.

- Serving the eviction notice to the tenant.

- Attending a court hearing.

- Following through with the eviction if the court rules in your favor.

Recommended Article: Early Termination of Lease Agreement

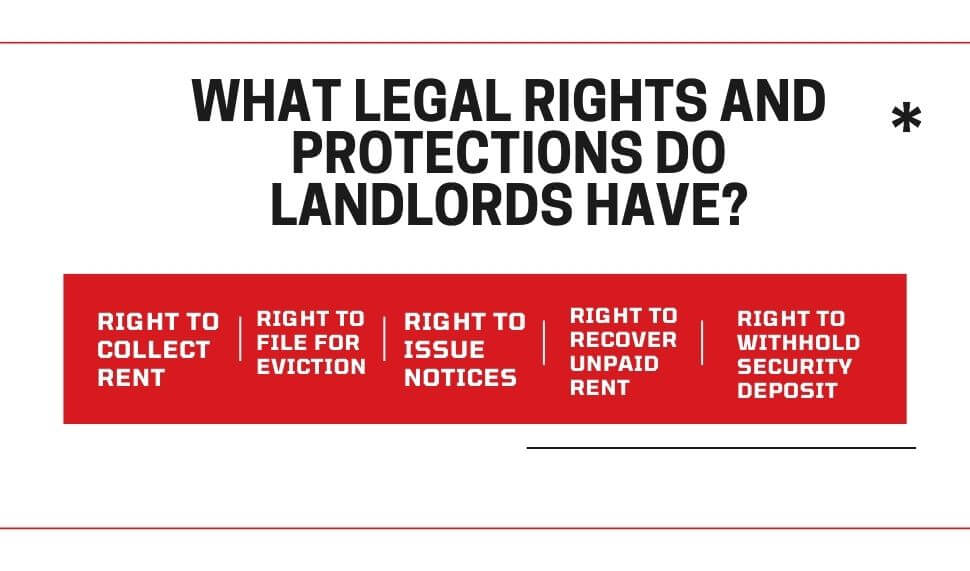

What Legal Rights and Protections Do Landlords Have When a Tenant Stops Paying Rent

A landlord’s rights and protections regarding non-payment of rent vary significantly from state to state and city. However, here’s a general overview of the rights and protections that landlords have when a tenant stops paying rent:

Right to Collect Rent and Enforce Lease Agreement: This is the most fundamental right. According to the lease agreement, you have the right to collect rent from the tenants. This includes the ability to charge late fees and other penalties permitted by the lease within the legal limitations set by the state. Any failure to pay rent constitutes a breach of lease agreement.

Right to Issue Notices: Most states allow landlords to issue various notices to tenants who violate the lease agreement, including non-payment of rent. These notices mostly include:

- Pay or Quit Notice: This notice informs the tenant of the missed payment, specifies a timeframe (mostly 3-30 days) to cure the breach by paying the rent, and warns of potential eviction if they fail to comply.

- Notice of Termination: After the cure period in the “Pay or Quit” notice has passed without payment, the landlord can send a termination notice, officially ending the tenancy and initiating the eviction process.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →Right to File for Eviction: If the tenant doesn’t comply with the “pay or quit” notice, eviction is the ultimate legal recourse for landlords when facing non-paying tenants. Evictions, however, vary greatly depending on the location. The following are some general steps to follow:

- Court Filing: Filing a lawsuit in the appropriate court is required to obtain a judgment and legal eviction order.

- Court Hearing: Presenting evidence of the lease agreement, non-payment, and notices served to the tenant is crucial.

- Eviction Order: If the court rules in favor of the landlord, they’ll issue an eviction order requiring the tenant to vacate by a specific date.

- Enforcement: Law enforcement might be needed to remove the tenant if they fail to vacate by the deadline.

Right to Recover Unpaid Rent and Damages: Landlords, in most cases, can legally seek compensation for:

- Unpaid Rent: This includes the rent owed when the tenant occupied the property without paying.

- Late Fees and Other Penalties: As per the lease agreement, landlords can collect late fees and other penalties mentioned in the contract.

- Damages Beyond Normal Wear and Tear: Landlords can seek compensation for any damage the tenant caused to the property beyond normal wear and tear during their tenancy. This involves deductions from the security deposit or filing a separate lawsuit, depending on the amount.

Right to Withhold Security Deposit (with limitations): Most states allow landlords to withhold a portion of the security deposit to cover unpaid rent after fulfilling all legal requirements for deductions and returning the remaining amount to the tenant within the legal timeframe after move-out, as per local regulations. For more details, you can check out the article Can a landlord keep security deposit.

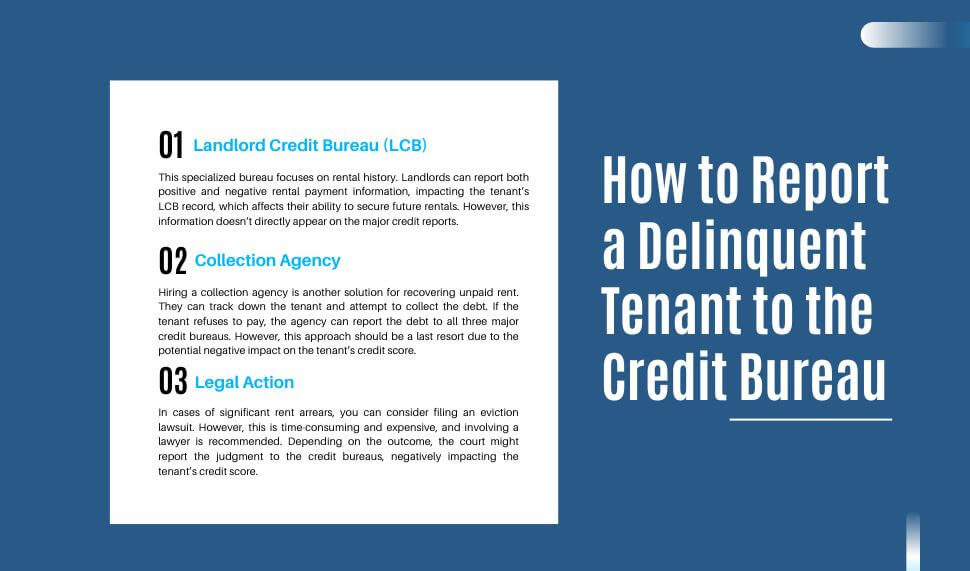

How to Report a Delinquent Tenant to the Credit Bureau

The purpose of reporting a delinquent tenant is to have an accurate, adverse payment history on the tenant’s credit file, encourage the tenant to make payments, and warn future landlords. However, following proper legal procedures and documenting all communication attempts is crucial. In the U.S., individual landlords typically cannot report directly to the major credit bureaus (Experian, Equifax, and TransUnion) due to legal restrictions requiring a merchant account. Here are some alternative courses of action landlords can consider:

- Landlord Credit Bureau (LCB): This specialized bureau focuses on rental history. Landlords can report both positive and negative rental payment information, impacting the tenant’s LCB record, which affects their ability to secure future rentals. However, this information doesn’t directly appear on the major credit reports.

Requirements:

- Requires a third-party service provider like FrontLobby to report information.

- Landlords need to sign up for this service, which may incur costs.

- Collection Agency: Hiring a collection agency is another solution for recovering unpaid rent. They can track down the tenant and attempt to collect the debt. If the tenant refuses to pay, the agency can report the debt to all three major credit bureaus. However, this approach should be a last resort due to the potential negative impact on the tenant’s credit score.

Requirements:

- Costs associated with hiring the collection agency.

- Potential legal implications depending on your state’s laws.

- Legal Action: In cases of significant rent arrears, you can consider filing an eviction lawsuit. However, this is time-consuming and expensive, and involving a lawyer is recommended. Depending on the outcome, the court might report the judgment to the credit bureaus, negatively impacting the tenant’s credit score.

How to Prevent Tenants Not Paying Rent

It’s true that you can’t guarantee every tenant will pay on time. However, you have to learn from this experience and not let it happen with future tenants. Here are some strategies you can take to reduce the risk of rent arrears:

Thorough Tenant Screening: Before accepting a tenant, conduct a comprehensive screening process. This should include checking their credit history, employment verification, rental history, and references from previous landlords. A thorough screening can help identify potential red flags and reduce the likelihood of renting to tenants with a history of nonpayment.

Clear Lease Agreement: Your lease agreement should clearly describe the terms and conditions of rent payment, including the due date, acceptable payment methods, late fees, and consequences for nonpayment. Make sure the tenants read and understand the lease agreement before signing it.

Collect a Security Deposit: Request a security deposit from the tenant before they move in. If there is no payment or damage to the property, the security deposit serves as a financial cushion. Depending on your state, you may be limited in the amount you can collect as a security deposit and how it should be handled.

Prompt Rent Collection: Communicate the due date for rent and provide multiple payment options such as online payment, direct deposit, or mailed checks. Make it convenient for tenants to pay their rent on time. Consider sending reminders a few days before the due date to ensure they remember.

Enforce Late Fees: Include a late fee clause in your lease agreement and enforce it consistently. Late fees can serve as a deterrent for tenants who might not take rent payments seriously. Ensure that the late fee policy complies with local laws.

Regular Property Inspections: Conduct periodic inspections of the property to assess its condition and identify potential issues. This will help you address maintenance problems early on and maintain a visible presence as a landlord, which can discourage nonpayment.

Swift Action for Nonpayment: If a tenant fails to pay rent, take immediate action. Send a written notice to the tenant, reminding them of the overdue rent and any applicable late fees. If the issue persists, consult local laws and regulations regarding eviction procedures. In some cases, it may be necessary to pursue legal action to recover unpaid rent or initiate eviction proceedings.

Conclusion on Tenant Not Paying Rent

Dealing with a tenant who doesn’t pay rent can feel overwhelming, but having a clear, step-by-step plan makes it much more manageable. As a landlord, your priority should always be to stay informed, act professionally, and follow your state’s legal process. Start with open communication, and many payment issues can be resolved simply by understanding the tenant’s situation. If that doesn’t work, use your legal rights, including issuing proper notices and eventually pursuing eviction if necessary. It’s about balancing empathy with business sense to protect your investment.

Looking ahead, prevention is your best tool. Thorough tenant screening, a well-drafted lease agreement, and consistent rent collection policies will go a long way in avoiding nonpayment problems in the future. Make sure tenants understand your expectations from the start, and don’t hesitate to enforce late fees or initiate action if rent becomes overdue. With the right approach, you can maintain positive landlord-tenant relationships while keeping your rental income steady and secure.

As a landlord, it’s tough to stay on top of all the issues that arise with your rental properties. Thus, considering to hire a property management company? OKC Home Realty Services is the best solution to keep your cost down and your tenants happy. Schedule an appointment to know how we can help you with your rental.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →FAQs on Tenants Not Paying Rent

Can a landlord withhold the security deposit for unpaid rent?

Yes, in most states, landlords are legally allowed to withhold some or all of a tenant’s security deposit to cover unpaid rent. However, the deposit amount, typically equal to one or two months’ rent, may not fully cover the total rent owed. If the rent arrears exceed the deposit, you may need to pursue legal action or use a debt collection process to recover the remaining balance.

Do I have to refund the security deposit if the tenant was evicted?

No, security deposits can be kept to cover any back rent, legal fees or property damage resulting from the eviction. The landlord has no obligation to return a deposit if the tenant was found to be in violation of their lease terms.

Can tenants break the lease early if they can't pay rent?

No, tenants are responsible for the full term of a lease agreement and any rent due until it expires. However, landlords have a duty to mitigate damages by attempting to re-rent the unit promptly. Tenants may negotiate an early surrender if they pay necessary costs like lost rent until a replacement moves in.

Can I change the locks if the rent isn't paid?

No, changing locks without a court-ordered eviction is illegal in most areas and could result in fines or legal trouble for landlords. The proper route is always serving official written notices and going through the jurisdiction's formal eviction process. For more information, Go through the article, Can a Landlord Change the Lock?

What if the tenant claims inability to pay due to hardship?

If tenants provide evidence of legitimate financial hardship from circumstances beyond their control, like job loss. In that case, landlords may agree to a temporary payment plan, such as a partial rent payment option, in a written agreement. However, lack of payment ability doesn't void the outstanding rental debt or remove the need for compliance with proper legal proceedings.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(