Real estate investing in Oklahoma City is/was one of the smartest moves I’ve made. This article focuses on all the reasons why real estate investing in Oklahoma City is STILL a wise move. Also, know Oklahoma city’s real estate market in detail.

Last year, my daughter and I were walking in downtown Oklahoma City.

I was marveling at how far my city has come.

We walked by the glimmering Devon Tower, Oklahoma’s tallest building at 52 stories. Next, we walked by the arena where the Oklahoma City Thunder, our pro basketball team, plays. And also through the downtown park where we saw our new light rail train pass by.h

Oklahoma City had none of these when I first arrived in 1992. I’ve been an enthusiastic Oklahoma city real estate investor since 1996. In this article, I want to share with you why I continue to add to my real estate investment portfolio. And, why it’s at the top of the list for many out-of-state investors, especially California real estate investors. Also, get to know about every aspect of Oklahoma City Investment Property.

Want to know the best place to invest in real estate in Oklahoma? Here we have listed the Best cities to Invest in Real Estate Oklahoma

What is the Oklahoma City Metropolitan Area?

The Oklahoma City metro area is 6,359 square miles, which is one of the largest geographic areas in the US of any metropolitan area. As you can see below it includes Oklahoma City, Bethany, Midwest City, Del City, Edmond, Moore, Yukon, Mustang, Choctaw, Warr Acres, and Norman.

Oklahoma City Metro Population

As of 2015, the population of the Oklahoma City metro area was 1.4 million. The population of Oklahoma City was 643,648 as of 2017. The population of Oklahoma City grew by 11,274 between the middle of 2015 and the middle of 2016 (1.7%).

If you want details about Factors Affecting Real Estate Market, check out this article where you can find how Demographics affect the Oklahoma city real estate market.

Oklahoma City Metro Area Economy

One often stated myth about the Oklahoma City metro area economy is that it is overly dependent upon the oil and gas business. Granted, it was that over-dependence that caused the economy to crater in the early 1980s.

Get to know the Top Reasons to Invest in Real Estate in Oklahoma City

A closer look at the Real Data tells a Different Story

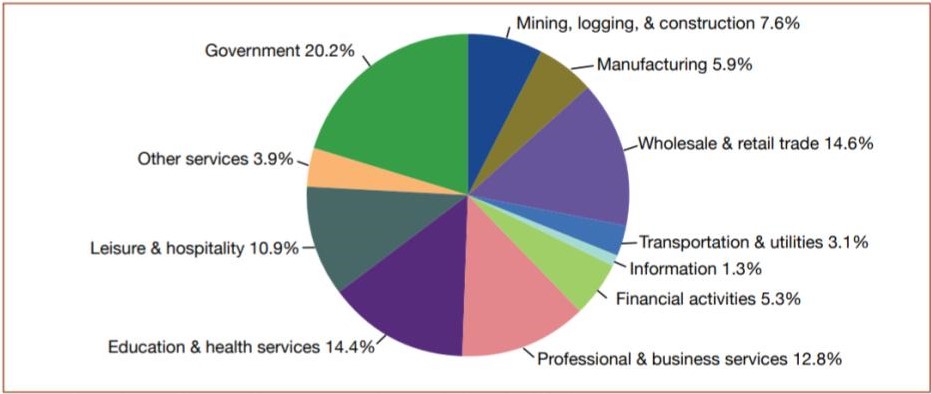

As you can see below, one-fifth of the jobs in the Oklahoma City metro area are government jobs. The four top employers in the area include the State of Oklahoma, Tinker Air Force Base, The University of Oklahoma, and the Federal Aviation Administration. All four of these are part of the government sector.

The pie graph below shows an economy that is well balanced, without over-dependence on one sector or another.

Non-farm payroll jobs in the Oklahoma City metro area by sector. Based on a 12-month average through March 2016. Source: Comprehensive Housing Market Analysis Oklahoma City, Oklahoma, US Department of Housing and Urban Development, data from US Bureau of Labor Statistics.

The Economy expanded throughout most of the 2000s

According to the Comprehensive Oklahoma City Housing Market, the economy expanded throughout the 2000s. Annual job growth varied from 0.1% to 2.3%, and only declined by 1.5% during the housing crash of 2009-2010.

The graph below shows that the largest gains in jobs were in mining, logging, and construction. As you might expect, the biggest gains (65%) were due to job growth as a result of big oil and gas players like Oklahoma City-based Devon Energy, Chesapeake Energy, and Continental Resources.

The $1.5 billion Metropolitan Area Projects (MAPS) included many local construction projects. That included the construction of the basketball arena to host the NBA Oklahoma City Thunder, a baseball stadium and canal in Bricktown, and many other projects around the city. I’ll talk more about how the MAPS has affected the quality of living below.

Know the basics of real estate investing and focus the time you have as Oklahoma city real estate agents in the right ways.

40% gains in Education and Health Services and Leisure and Hospitality

There are too many hospitals and clinics in the Oklahoma City metro to count. I tried. Predictably, this increase mirrors the national trend. Job growth in leisure and hospitality was aided by the popularity of the Oklahoma City Thunder, the expansion of hotels, and the myriad of events that occur in the area from college athletics to horse shows.

On the other hand, the largest job losses were from the information industry (40%+) followed closely by manufacturing (28%). These job losses occurred mostly during the economic downturn of 2009 and 2010, mirroring the national trend.

Note: Best Real Estate Investment Strategies for Beginners

Sector Growth in the Oklahoma City metro area between 2000 and 2016. Source: Comprehensive Housing Market Analysis Oklahoma City, Oklahoma, US Department of Housing and Urban Development, data from US Bureau of Labor Statistics.

During the stable economic period during the 2000s, the unemployment of the Oklahoma City metro area was 4.0%, compared to the national average of 5.1%.

Oklahoma City Metro Area Home Sales

Median home sales prices in the Oklahoma City metro area have been on a nice increasing trend since the housing crash of 2009-2010. The trend line suggests a 4% appreciation rate during that time.

The Median Sales price in the Oklahoma City metro area, 2006 to 2019. Source: MLSOK.

The housing market is stable. According to the comprehensive Housing Market Analysis, 3.1% of homes in the Oklahoma City metro area were seriously delinquent (90 days or more or in foreclosure), or had transitioned to bank-owned (REO) status. That compares to a national average of 6.6% during the same period (“Mortgage Delinquency Rates hit Lowest Level since Financial Crisis, Forbes.com).

Also Read: Tips for Real Estate Investors

Oklahoma City Metro Area Rental Property Statistics

According to the Department of Numbers, the percentage of renters in the OKC metro area in 2019 (41.8%, down 0.2% from the prior year) is above national averages (35.9%, down 1.0% from the prior year).

- Median rent for the OKC metro area in 2019 was $872 per month, down 3% from the prior year. That compares to a national average of $1,097, up 1.9% from the prior year.

- The average vacancy rate in the OKC metro area in 2017 was 8.5%, down 0.6% from last year. That compares to a national average of 6.0%, down 0.2% from the prior year.

- Rent as a fraction of income in 2019 was 18.6% in the OKC metro, down 1.7% from the prior year. That compares to a national average of 20%, down 0.5% from the prior year.

How to get rental income? Here is an answer.

Reasons Real Estate Investing in Oklahoma City Makes Sense

It’s definitely possible to find properties that make sense from a long-term investment standpoint in the OKC real estate market. As long as you make good choices upfront, you can find properties that will produce a positive cash flow. There is an excellent Rental Cash Flow Calculator for your ultimate decision-making.

Growth and Stability of Oklahoma City Real Estate Market

It’s clear the economy of the Oklahoma City metro area is on solid footing. This has supported the growth of the housing market. Investing in real estate in Oklahoma City wouldn’t be nearly as attractive if the job sector was weak. But unemployment is low, fueled by the dynamic economy, which supports a steady increase in population.

To summarize the points from above:

- The Oklahoma City metro economy is diversified over many sectors.

- The population is experiencing steady growth.

- Unemployment (4%) is below the national average.

- Real estate values are experiencing slow steady appreciation, at an approximate annual rate of 4%.

- Rents are increasing, keeping pace with the increasing price of real estate.

- The rental housing market is fairly tight, with an average vacancy rate of 8.5% last year.

Quality of Life Improvements

In 1991, Oklahoma City lost the opportunity to bring a United Airlines maintenance facility to Oklahoma City. The decision not to bring that facility, according to United, was based mostly upon the quality of living in Oklahoma City at that time. That loss was all the motivation the city leaders needed at that time for the beginning of the MAPS. In addition to what’s mentioned above, it brought the revitalization to Bricktown, Automobile Alley, the Downtown area, and a whole host of other improvements to the city.

After all, why would a business want to be in a community where its employees don’t want to be?

Since the 1990’s Oklahoma City has changed its trajectory from a city without much going on, to a place we’re proud to call home. And, more and more employers and their employees share the same sentiments.

I could go on and on, but I’ll let you search out additional information if you want:

Twenty-Five Things to Do in Oklahoma City

Thirty things to know about Oklahoma City before you move there

Rental Rates versus Sales Prices in Oklahoma City

The reason you are reading this article is to find out if you can get a good enough cash flow such that real estate investing in Oklahoma City would make sense from a return on investment perspective.

You can watch my YouTube video that discusses rental rates versus sales rates:

I don’t want to get too much into the weeds on this topic, so I’ll keep it short.

I’ve noticed there are two basic types of properties that my out of state clients who invest in single-family homes prefer:

- Newer Homes in nice neighborhoods

These are homes no more than 30 years old. They are located in nice areas such as Edmond, Yukon, Mustang, etc other newer housing additions with well-regarded schools. For the most part, the owners are aiming for a property in which the gross monthly rent is around 1% of the total investment. Because they are newer homes, the cost of maintenance is less. There should also be fewer tenant issues.

2. Older Homes in BC (as in the A-F grading system) neighborhoods

These houses are generally more than 30 years old. They are located in more blue-collar areas. Some of these are section 8 properties. In these cases, the owners are aiming for properties in which the gross monthly rent is 1.0% -1.5% of the total investment for the property.

These types of goals are just not achievable in many metropolitan markets throughout the US.

If you would like to see some current, available properties, give me a call, or fill out the form below the article.

Oklahoma is a Pro-Landlord State

Even though evictions have gotten tougher since the Covid pandemic, landlord-tenant laws in Oklahoma still favor the property owner versus the tenant.

If I want to evict a tenant for a lease violation or non-payment of rent, there is a five-day notice period. After that, I can file for a court date. That is usually a seven-day process.

Once the landlord or property manager has the court-issued judgment (same day as a court), the tenant has 48 hours to vacate or they can be locked out.

I am not aware of neighborhoods in the Oklahoma City metro area that have some type of rent control.

Strong Rental Demand in the Oklahoma City housing market

Let’s face it, real estate investing in Oklahoma City wouldn’t make much sense if there weren’t a strong demand for rental properties. The fact is, there is a strong demand for rental properties in the OKC metro area.

As stated above, the average rental property vacancy rate for the OKC metro area in 2017 was 8.5%.

As a result of this demand, 2,000-3,000 permitted multifamily units were built each year between 2012 and 2016 in the OKC metro area.

I would point to several factors that drive the demand for the two types of properties discussed in an item:

- Newer Homes in nice neighborhoods

There is a continuing influx of workers into the area and families that improve their economic position. They seek out these desirable rental properties. Credit standards are still tight. These factors prevent these same people from buying instead of renting.

2. Homes in BC neighborhoods.

There are not many new houses in the BC neighborhood being built. The exception to that is someone- and two-bedroom apartments, but for the most part, the newer ones are not aimed at low-income tenants. There is also a good market for lower-priced homes.

Recommended Article: Is Oklahoma City Section 8 Program Appropriate for Your Rental Property?

Is it too late to take advantage of Oklahoma City Real Estate Market?

It’s not too late. Here is what smart realtors in OKC do to get involved with this market:

- Learn the real estate market. Learn the values and rents in neighborhoods that have the types of properties in which you’d like to invest.

- Get your financing in place. If you’d like a referral to local bankers in our network, let us know.

- Put your on-the-ground team in place. That means interviewing OKC investment realtors, and OKC property management companies. You can learn much about the market just by visiting with professionals that are immersed in that market.

If you would like to see some current, available properties, call Property Management OKC company. OKC Home Realty Services understands how important your rental property is to you.

Also Read: How to pass a rental credit check?

Frequently Asked Questions about Real Estate Investing in Oklahoma City

What are the best neighborhoods to buy nice, modern homes in Oklahoma City?

I consider nice, modern homes to be those built in the last 10 years. You can find these types of properties in the suburban areas of the city, such as Yukon or Mustang on the western edge of Oklahoma City; Edmond has many newer homes; the I-240 corridor in southeast Oklahoma City and the northern portion of Moore; and the area of eastern Midwest City. There is also still plenty of construction of new homes as of late 2020/2021.

Is it possible to find good deals on single-family homes in Oklahoma City?

You can buy older rental properties for less money per square foot than newer homes. For example, it’s possible to find good deals on single-family homes in rougher Oklahoma City neighborhoods for $60,000-$80,000. Those aren’t going to lease for as much as a newer, nicer property, but the overall cash flow will be better because you will have less invested (assuming you are financing the purchase). You might get rents from $700 to $900 per month for these types of properties. Obviously, each property is going to be a little different, so you’ll have to do an evaluation on a case-by-case basis.

What type of return on investment could you expect for a new home in a nice neighborhood?

Suppose you purchase new single-family homes, 3 bed 2 baths with 2 car garages for $150,000. Here are some projections, not actual revenue or expenses: You could expect the property to rent for about $1,300 per month. Here are the expenses you could expect on an annual basis: Tax $1,800; Insurance $1,300; Maintenance $650; Vacancy $650; and management fees $1,200. Total annual expenses would be $6,900 in that example. What would you a net operating income of $725 per month? In terms of cash flow, if you did not have a loan on the property, the annual return on investment would be 5.8%. Add the appreciation over the long run that is likely and you have yourself a sound investment for some investors. Note that there is no guarantee of return implied. This is only an example for demonstration purposes only. And, the above return calculation doesn’t factor in any financing.

What is the best way to find an investment realtor in the OKC metro area?

There is a big difference between realtors who specialize in finding properties for people who will live in properties versus a realtor who find good deals for real estate investors.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(