Landing that perfect rental home can feel like a dream come true. However, one major hurdle stands in your way – the rental credit check. Landlords or property management companies conduct rental credit checks to evaluate your financial stability and reliability in meeting financial obligations promptly.

Landlords use this check as a form of background verification to ensure the information you have provided in the rental application is accurate and trustworthy. Passing a rental credit check from landlords or property managers is important because it increases the chances of securing the rental home of your choice. In this article, we’ll break down what is a credit check for renting and how to pass a rental credit check to rent a property.

What is a Credit Check for Renting?

A credit check for renting is a process used by landlords or property management companies to evaluate a prospective tenant’s creditworthiness before approving a rental application. The purpose of a credit check in the context of renting is for the landlord to reduce risk. By ensuring a potential tenant has a history of paying bills on time and managing credit responsibly, the landlord can feel more secure in your ability to pay rent regularly and on time.

Most landlords have minimum credit/income standards for approval. Managing your credit card limit can also demonstrate financial responsibility and credit management skills to landlords, making you a more attractive tenant. So, having a good credit history can increase your chances of securing a dreamt rental, while a bad credit history can lead to a denial of rental application.

Why Do Landlords & Property Management OKC Run Rental Credit Checks?

The rental credit check process involves obtaining your credit report for a rental application to determine your eligibility. By evaluating your credit history, landlords and property management companies can have valuable insights into your financial responsibility and payment behavior. This process helps protect landlords’ financial interests and promotes a responsible living environment for all tenants. Here are some reasons to run rental credit checks to property owners:

- Rental credit checks help landlords make informed decisions about which applicants are trustworthy to fulfill the lease terms, including paying rent on time and taking care of the rental property.

- Credit checks for renting also reveal whether a tenant has an eviction history, bankruptcies, or other financial problems, which are potential red flags for landlords.

Also Read: What does a property manager do?

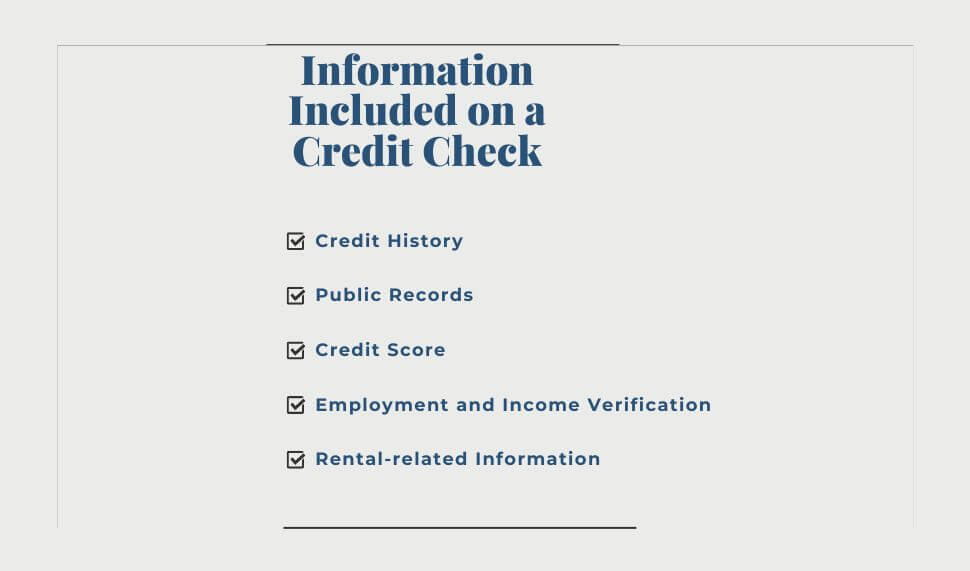

What Information is Included on a Credit Check for Rental Applications?

A credit check is an important tenant screening tool for landlords and property management companies to decide whether to approve your lease application. However, not all landlords look at the same information. This can vary based on the landlord’s preferences. Some landlords only verify a prospective tenant’s identity and check the credit score, while others can scan for several red flags for them. Here are the major information landlords look at while running credit check for rental applications:

Credit History: Your credit history shows a list of credit accounts, such as credit cards, loans, and mortgages, along with the payment history. Even any late or missed payments are included. This helps landlords to identify that you have made payments on time, preventing the owner’s financial loss.

Public Records: These records provide insight into your financial history beyond credit accounts. Bankruptcies, tax liens, and civil judgments are included, which are taken as indicators of past financial difficulties or legal issues.

Credit Score: As per Experian Data 2022, the average FICO® score in the U.S. is 714. Though a higher score indicates better creditworthiness, most landlords never expect quite higher scores of applicants to lease their properties.

Employment and Income Verification: Landlords want to confirm your current employment status and income to ensure you have a stable source of income to pay the rent. This can be done through pay stubs, employment verification letters, or direct contact with the employer.

Rental-related Information: This information enhances the rental prospects by influencing a landlord’s decision. Information like previous evictions, rental payment history, and any outstanding balances to prior landlords are included here.

[Also Read: Can Landlords Ask for Bank Statements for a Rental Application]

How to Pass a Rental Credit Check: Step By Step Guide

To successfully pass a rental credit check, begin by checking your credit report from major bureaus like Equifax, Experian, and TransUnion. This allows you to review your credit history for any errors or inaccuracies, which you can dispute if found. Thus, passing a rental credit check is crucial when renting, especially for those facing the challenges of a poor credit score. Circumstances such as job loss, falling behind on bills, or needing more credit experience can lead to a less-than-ideal credit score, impacting your rental application. However, understanding how to deal with these challenges and presenting yourself as a responsible tenant dramatically increases the prospect of moving into a new place. Here are major processes to help you pass a rental credit check on the rental application process:

- Check Credit Report and Score

- Improve Credit Score

- Prepare for the Rental Application

- Provide Proof of Income

1. Check Credit Report and Score: Checking your credit report and score is the step forward to see where you stand before applying for a rental application. Every individual has the right to collect a free copy of their credit report from the credit bureau and reporting agencies (Equifax, Experian, and TransUnion). Once you have a report, review it carefully and address any errors or issues immediately. This report is vital for increasing your chances of securing dreamt rentals. A higher credit score can give you leverage in negotiations. Though you have a low credit score, it doesn’t mean the landlord will ignore your application unless you explain it to the landlord with valid reasons.

2. Improve Credit Score: Demonstrating on-time payments reflects your reliability, which is a significant factor in credit scores. If you have a low credit score when applying for a rental, you can improve your chances of approval by settling off all your outstanding debts and keeping your credit utilization low. Avoid any big purchases that could negatively impact your credit score. To minimize the impact of a bad credit score, set up automatic payments or reminders to ensure you never miss a due date. However, it takes time to improve your credit score, so starting early is worth it in the long run.

3. Prepare for the Rental Application: When you are ready to apply for a rental, provide the landlord with the necessary information, such as your name, contact information, employment history, and income information. You also need to provide references from previous landlords who can provide a testament to your reliability and responsibility as a tenant.

4. Provide Proof of Income: It is crucial to demonstrate that you have a steady income. Thus, present solid evidence of income that shows your financial stability. This can include pay stubs or an employment letter verifying your income. If self-employed, provide tax returns and bank statements to prove steady income. Landlords usually look for tenants whose monthly income is at least 3X the monthly rent.

How to Rent a Property If You Have a Low Credit Score?

While a low credit score can make it more challenging to rent a property, there are other ways to make it possible. Landlords view poor credit scores as a potential risk, as it suggests a history of financial instability or late payments. You should remember that preparation and transparency are key to unlocking your way, even with a low credit score during rental application checks. Follow these strategies, and you’ll be well on your way to acing your rental credit check.

- Be Honest and Transparent

- Offer a Higher Security Deposit

- Offer a Co-Signer

- Provide References

- Consider a Shorter Lease Term

Be Honest and Transparent: Rather than hiding, show you are self-aware about your credit score with your potential landlords. When communicating your credit reports with the landlord, act professionally and respectfully. Explain any negative marks on your credit report and the steps you are taking to improve your financial condition.

Offer a Higher Security Deposit: Landlords keep the rental applicants with low credit scores at a low priority. In this case, offering a larger security deposit can convince your prospective landlords enough to overlook a low credit score. This reduces their financial risks, making them more willing to approve your rental application.

Offer a Co-Signer: If your landlord is comfortable with such an option, you can ask a financially stable friend or family member to co-sign the lease. The co-signer’s good credit score can offset your lower score. This provides added assurance for the landlord and approves your rental application.

Provide References: Provide strong personal and professional references to vouch for your reliability and financial responsibility as a tenant. This can include previous landlords, employers, or colleagues who help in the landlord’s decision-making process.

Consider a Shorter Lease Term: Proposing a shorter lease term, such as six months, demonstrates your willingness to work with the landlord’s concerns while still providing you with a comfortable living arrangement. It is a compromise that can be mutually beneficial for both parties. You can also make an informed decision on this by calculating your rent affordability.

How to Improve Your Credit Score Before the Check?

If you have some time before submitting your rental application and your credit report is pulled, there are proactive steps you can take to try raising your credit score. Even modest improvements could help your chances. Here are some effective tactics:

- Pay Down Balances

- Make All Payments On Time

- Limit Credit Applications

- Dispute Errors

- Ask for Credit Limit Increases

- Become an Authorized User

Pay Down Balances: One of the biggest factors in most credit score calculations is your credit utilization ratio – the percentage of available credit you currently use. The goal should be keeping this below 30% of your total limits. Paying down credit card balances, personal loans, or other revolving debt reduces utilization and puts you in a better position. Settle larger debts, if possible, to eliminate late payments.

Make All Payments On Time: Payment history counts for about 35% of most FICO scores. Stay current on everything from credit accounts and loans to phone/utility bills. Being 30 days late has badly affected your report for years. Set payment reminders if needed to avoid any slips.

Limit Credit Applications: Each hard inquiry lowers scores a few points in the short term as it suggests more credit risk-taking. Space out applications and only apply for necessary loans or accounts in the months before a credit check.

Dispute Errors: Check your report through AnnualCreditReport.com and look for any errors affecting the accuracy of your history. Dispute incorrect late payments, account balances, collection notices, and other blemishes with the bureaus to have them investigated and potentially removed.

Ask for Credit Limit Increases: Higher credit limits across accounts mean lower utilization ratios after spending the same dollar. Contact card issuers to request increasing your spending allowances based on timely payments, which will also be reported to bureaus.

Become an Authorized User: See if parents or someone with great credit will add you as an authorized user to one of their older, well-settled credit card accounts. This is reported without your responsibility, and lenders see the high limits and payment history that build your own reported profile instantly.

Final Thoughts

Landlords use credit checks as one factor in their decision-making when evaluating potential tenants. If you get into it with the right approach, you can easily pass the rental credit check. It is also important to consider that landlords are not allowed to discriminate against applicants based on their credit scores. The screening process should comply with Oklahoma fair housing laws and treat all applicants equally. In such cases, OKC Home Realty Services is here to help you navigate the process smoothly. We aim to secure the best rental options for both prospective tenants and landlords. Get in touch today for hassle-free property management and a profitable rental experience.

Rent anytime. Move anytime.

FAQs on Passing Rental Credit Checks

Can a low credit score lead to rental rejection?

Yes, a low credit score may raise concerns for landlords as it suggests a history of financial difficulties.

What if I have no credit history at all?

In the absence of a credit history, providing proof of income and offering a co-signer can carry significant weight in the application process.

Is a background check different from a credit check?

Yes, while a credit check assesses your financial history, a background check examines your criminal history, rental history, and more.

Can I take steps to improve my credit score before applying for a rental?

Absolutely. Paying down debt, disputing inaccuracies, and maintaining a healthy credit utilization ratio can help boost your score.

Should I be upfront about my credit history with the landlord?

Being transparent about any potential issues in your credit history is advisable. It demonstrates honesty and can provide an opportunity to explain any extenuating circumstances.

Does my cosigner need good credit, too?

Absolutely. Cosigners must pass the same credit/background screening as primary applicants. Their excellent, established history supplements your application.

How long does a rental credit check usually take?

Most property managers process applications and pull credit within 3-5 business days. Make sure to submit complete paperwork so there are no delays waiting on missing info.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(