Whether you are investing in real estate and rental properties for the first time or a renter seeking clarity on who handles your day-to-day concerns, it is important to know the differences between a landlord and a property manager. Both roles overlap in rental scenarios, but are two different things, affecting everything from maintenance to financial obligations.

A landlord is typically the property owner, the individual or entity who purchases the real estate and bears ultimate ownership risks and rewards. They set rental rates, decide on major upgrades, and collect profits after expenses. Whereas, a property manager acts as a hired professional (or firm) who oversees operations on behalf of the landlord, handling tenant screening, rent collection, repairs, and compliance with local laws.

This blog will break down the key differences between landlords and property managers, exploring their roles, responsibilities, advantages, and drawbacks. By understanding how each functions, you can make an informed decision on whether to self-manage your rental property or hire a professional, ensuring your investment runs smoothly and profitably.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →What is a Landlord? Roles and responsibilities

A landlord is someone who owns residential or commercial real estate and leases it directly to tenants in exchange for regular rental payments. This role entails full legal ownership responsibility, including mortgage obligations, property taxes, insurance, and compliance with local landlord-tenant laws.

The main landlord’s role and responsibilities include:

- Own the property and hold the title

- Sign and enforce the lease

- Collect monthly rent

- Follow the Fair Housing Act and local housing codes

- Pay for capital expenses like roof or HVAC replacement

- Report rental income, expenses, and depreciation for taxes

What is a Property Manager? Roles and responsibilities

A property manager is a licensed third-party professional or firm hired to oversee the day-to-day operations of a rental property on behalf of the owner. These professionals don’t own the property and act as agents by taking a certain management fee under a property management agreement.

The main roles and responsibilities of a property manager:

- Sign a management agreement defining the scope and rules with the landlord

- Charge a percentage-based management fee

- Screen tenants using background, income, and credit checks

- Coordinate repairs and maintenance vendors

- Provide rent collection and financial reports

- Support legal compliance with landlord-tenant laws

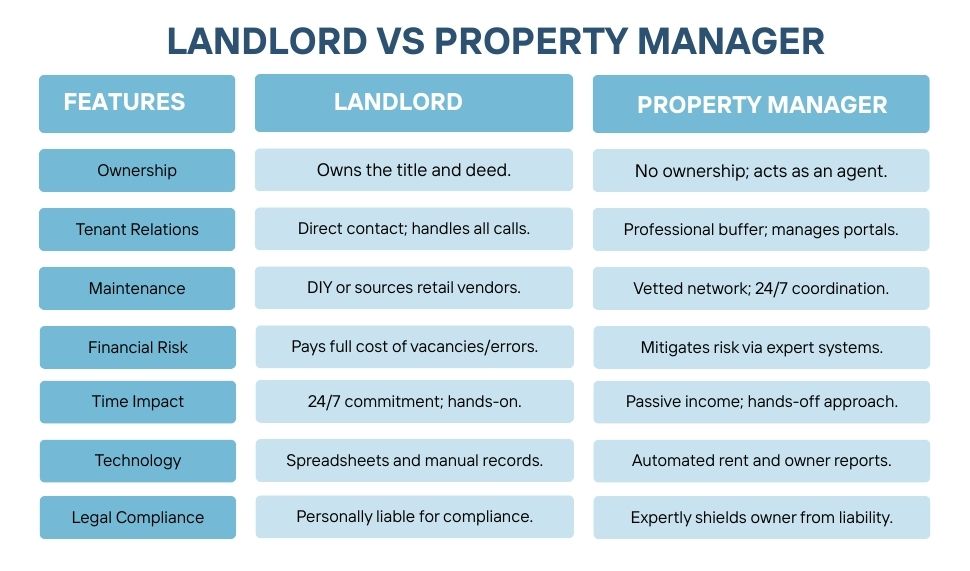

7 Major Differences Between Landlord and Property Manager

Landlords and property managers keep a rental property running, but they operate very differently. Here are 7 key differences between a landlord and a property manager:

1. Ownership

A landlord holds full legal ownership and operational control, making all decisions on rent pricing, tenant selection, lease terms, and property improvements. This autonomy allows for rapid adjustments and personalized standards but concentrates liability as owners are directly responsible for compliance errors, which can trigger lawsuits for fair housing or eviction missteps.

While a property manager performs day-to-day activities on behalf of the owner within agreed boundaries. The property manager acts as a middleman between owner and tenant, reducing personal liability and stress, though it requires trust and clear communication.

2. Tenant Relations

The landlord directly interacts with tenants in marketing, leasing, rent collection, and conflict resolution. While this may create a good relationship between the landlord and the tenant, as it may solve minor issues quickly, it also poses risks to the landlord, such as emergencies, rent discussions, and legal issues in case of screening and communication.

On the other hand, Property managers act as a middleman, enforcing lease agreements and keeping owners away from any conflict with the tenants. Property managers use compliant screening criteria, provide documented communication through tenant portals, and offer 24/7 response coverage, which increases tenant satisfaction while also maintaining the privacy of the owners.

3. Maintenance and Repairs

Self-managing landlords are typically responsible for all repairs, ranging from sourcing vendors to negotiating prices, scheduling repairs, and verifying quality. While this allows owners to select preferred contractors and avoid management markups, it demands industry knowledge to avoid overpaying or hiring unlicensed workers and requires immediate availability for emergencies like burst pipes or lockouts.

In contrast, Property managers can handle the maintenance and repair on behalf of the landlord if it’s mentioned in the contract. Property managers often leverage established vendor networks for faster, often discounted services and coordinate everything from routine fixes to urgent issues.

4. Financial Risk

A self-managing landlord eliminates management fees (usually 8-12% of monthly rent), potentially increasing net cash flow annually. However, landlords often pay retail prices for services, face higher vacancy rates, and bear the full cost of tenant turnover, litigation, or regulatory mistakes. These risks can easily offset management fee savings.

Property managers make financial management easier by creating and maintaining budgets, monitoring rent collection, and offering in-depth financial statements. Property Managers charge between 8-12% of the monthly rent and utilize their expertise to mitigate risks such as late payment or vacancy, while also adhering to accounting regulations and laws. This arrangement provides a stable source of cash flow for passive investors.

5. Time Commitment & Lifestyle Impact

Landlords managing property on their own have to spend significant time monthly on tasks like tenant communication, maintenance coordination, marketing during vacancies, and financial tracking. This commitment can conflict with full-time careers, family obligations, or travel plans, and emergency calls don’t adhere to business hours. While this can be a fulfilling experience for local landlords who have the flexibility of their schedule and experience in the hospitality industry, it can be a nuisance for others.

Property managers follow a streamlined process and reduce owner time commitment to minimal hours monthly for review calls, financial reporting, and strategic decisions. This allows for remote investing, portfolio scaling, and true passive income, particularly valuable for professionals, retirees, or out-of-state owners. While management fees represent a cost, many investors find the reclaimed time and reduced stress deliver greater overall value than the saved fees.

6. Technology & Reporting Transparency

Landlords who manage their own properties often rely on basic tools such as spreadsheets, personal email, and phone calls to track income, expenses, and maintenance. Although inexpensive, this approach can lead to disorganized records, missed deductions, and limited visibility into property performance, complicating tax preparation and strategic planning.

Property managers utilize dedicated software platforms for automated rent collection, maintenance tracking, financial reporting, and owner dashboards. Owners receive monthly statements, year-end tax summaries, and real-time performance metrics without manual effort. This transparency supports better financial decisions, simplifies accounting, and provides the data needed to optimize rent pricing, plan capital improvements, or evaluate portfolio performance.

7. Legal & Regulatory Compliance

Landlords must stay updated with the latest 2026 regulations, including fair housing laws, eviction procedures, security deposit limits, and local licensing requirements. Even small mistakes, such as improper notice periods or discriminatory screening criteria, can result in fines, lawsuits, or invalidated evictions.

Property managers specialise in regulatory compliance as one of their main services, and are always familiar with federal, state, and local laws governing rentals. They have standardized processes for screening, leasing, and eviction that are legally sound, shielding the owner from liability. They know the laws, follow the right processes, and keep correct documentation to keep you out of trouble and minimize legal liability issues.

Maximize Your Rental Income with Hassle-Free Property Management

Request a Service →Can a landlord also be a property manager?

Yes, the landlord can be a property manager. In fact, many small-portfolio landlords, especially those owning single-family homes, duplexes, or a handful of rental units, choose to manage their properties themselves to save on fees and maintain direct control. In this approach, the owner handles all aspects of the rental operation: marketing, tenant screening, lease execution, rent collection, maintenance coordination, and compliance.

While self-managing the property is possible, it is not a recommended approach as it requires significant time and legal knowledge. Without professional tools or experience, landlords risk costly mistakes, such as fair housing violations, delayed repairs leading to tenant turnover, or improper evictions that invite lawsuits.

What Are the Pros and Cons of Self-Managing?

Managing a property on its own as a landlord gives full control, but it also comes with additional responsibilities. Below is a breakdown of the pros and cons of self-managing the property as a landlord:

Pros

Retains Full Rental Income

Managing property independently as a landlord can eliminate property management fees, which typically range from 8–12% of monthly rent. On a $1,200/month OKC rental, that amounts to approximately $1,150–$1,440 back annually, improving ROI. All rent collected goes directly to the owner, with no management fees, reducing monthly cash flow, further enhancing the overall return on investment.

Maintains Direct Control

Landlords who also act as property managers have direct authority over every aspect of the rental operation, from tenant selection criteria to lease terms and vendor choices. All decisions regarding rental pricing, screening criteria, repair vendors, and lease terms are made solely by the owner, without relying on a third party or waiting for outside approval. This ensures full control over how the property is managed and maintained.

Flexible Decision-Making

Self-managing landlords have the ability to respond quickly to changes in the market or tenant needs. Decisions such as adjusting rental rates, implementing property improvements, or offering lease incentives can be made immediately, without waiting for approval from a third-party manager. This flexibility allows landlords to optimize income, maintain tenant satisfaction, and adapt to evolving property conditions efficiently.

Direct Tenant Relationships

Developing a personal bond with tenants can foster better communication and mutual respect. This often results in longer lease terms, reduced turnover, and faster attention to maintenance or other property issues, contributing to smoother property management overall.

Cons

Legal Liability

Landlords are responsible for understanding and complying with local landlord-tenant laws, the Fair Housing Act, habitability standards, and proper eviction procedures. Even minor errors or oversights can result in fines, legal action, or other costly consequences.

Time-Consuming

Managing a property independently requires handling showings, phone calls, rent collection, and tenant complaints. Emergencies can arise at any time, demanding availability around the clock and potentially impacting personal life and weekends.

Maintenance Coordination Burden

Landlords are responsible for finding, vetting, and paying contractors for all repairs. Without an established professional network, costs are often higher, and securing reliable assistance promptly can be challenging.

Vacancy Losses

Landlords who self-manage often take longer to screen tenants and fill vacant units, which can significantly reduce profits. Even a few months of vacancy can outweigh the savings gained from avoiding a full year of professional management fees.

What are the Pros and Cons of Hiring a Property Manager?

Hiring a property manager shifts daily rental responsibilities to a professional team. While some income is exchanged for management fees, landlords gain convenience, structure, and reduced personal involvement. Below are some reasons you should hire a property manager and the tradeoffs you face:

Pros

Lower Vacancy Rates

Professional property managers promote rental properties across multiple listing platforms using optimized descriptions and professional photography. This approach helps attract qualified tenants more quickly, reducing vacancy periods and ensuring the property generates consistent rental income.

Legal Protection

Experienced property managers have in-depth knowledge of landlord-tenant law, Fair Housing requirements, and proper eviction procedures. Their expertise ensures that rental properties remain legally compliant, reducing the risk of fines, lawsuits, or other legal issues.

Reduces Time Commitment

Property managers handle all aspects of tenant communication, showings, and paperwork, transforming the rental into a more passive investment. This reduces the landlord’s daily involvement, allowing focus on portfolio growth or other priorities.

Vendor Network Access

Property managers maintain an established network of vetted local contractors, enabling faster repairs and often securing better rates than most individual landlords could negotiate independently.

Streamlines Maintenance

Tenants submit maintenance requests through a dedicated portal, and the property manager coordinates the appropriate vendors. All work is tracked and documented from start to finish, ensuring timely completion and clear records for both the landlord and tenants.

Peace of Mind

Having a licensed property management team handle operations and legal compliance allows landlords to invest with confidence. Rent collection, maintenance, and tenant relations are managed systematically, reducing stress and ensuring the property is properly cared for.

Cons

Management Fees

Hiring a property manager requires paying a monthly fee, typically 8–12% of collected rent. While this reduces net income, the fee covers operational, legal, and maintenance services that would otherwise be the landlord’s responsibility.

Less Direct Control

Day-to-day operational decisions are handled by the property manager. Landlords approve major actions, but smaller decisions are managed by the professional team, which can limit direct control over certain aspects of the property.

Transition Period

Switching to a property manager requires setup time. Leases, tenant records, and maintenance histories must be transferred, tenants notified, and management systems established. This process typically takes several weeks before operations run smoothly.

When Is It Worth It for a Landlord to Hire a Property Manager

Deciding to hire a property manager depends on the landlord’s goals and the current state of the rental business. If several of the following situations apply, it may be time to consider professional management:

Multiple Properties: Managing two or more rentals simultaneously can become complicated quickly. A property manager can scale with the portfolio without multiplying the landlord’s workload.

Distance from the Rental: Landlords living more than 30 minutes away, or out of state, may find it unrealistic to handle maintenance calls, showings, and tenant issues in person. Local property managers can coordinate emergencies and on-site needs efficiently.

Limited Time: Balancing a full-time job, family, and other commitments can make self-managing a rental stressful and time-consuming. A property manager reduces the burden and ensures timely management of the property.

Legal Uncertainty: Oklahoma has specific rules regarding leases, deposits, evictions, and habitability. Landlords uncertain about legal compliance can benefit from a professional manager who protects against costly mistakes.

Cash Flow Capacity: When the property has a healthy margin, management fees are often a worthwhile investment for professional growth, operational efficiency, and risk mitigation.

Portfolio Growth: Property managers facilitate expansion by handling operations, allowing landlords to acquire additional properties without burnout or operational bottlenecks.

Why Landlords Trust OKC Home Realty Services for Property Management

The main difference between a landlord and a property manager is ownership versus operation. A landlord owns the rental property and carries financial and legal responsibility. A property manager runs daily operations, handles tenants, coordinates maintenance, and supports legal compliance. The landlord builds equity and earns rental income. The manager earns a management fee and acts as the landlord’s agent. Both roles aim for the same goal: a profitable rental, but the path you choose determines your daily responsibility and long-term scalability.

If you’re an OKC rental owner ready to make that shift, OKC Home Realty Services offers local market expertise that only comes from 20+ years in the Oklahoma City real estate market. We don’t just collect rent; we provide a full-service package. Our team strictly adheres to licensing and compliance standards, uses rigorous tenant screening protocols, and leverages an exclusive maintenance vendor network to keep your costs down. With an average vacancy rate performance of 4.6% and transparent reporting systems, we make your ROI our priority.

Over 3,200 Oklahoma City metro landlords have trusted us with their investments. Ready to join them? Schedule a free consultation or contact us at (405) 232-5800.

Is a property manager necessary for a first-time landlord with one house?

Not strictly necessary, but highly recommended. First-time landlords have a steep learning curve related to tenant screening, lease laws, and maintenance coordination. A property manager removes that guesswork from day one and helps you avoid costly rookie mistakes.

How to transition from being a landlord to using a property manager?

First, sign a property management agreement. Then transfer leases, tenant records, and maintenance history. The manager notifies tenants and takes over rent collection and communication.

Are property managers and landlords the same thing?

No. A landlord owns the property. A property manager operates it on the owner’s behalf. They’re different roles.

What percentage of landlords use property managers?

Roughly 50% of rental properties in the US are managed by professional property managers. That number grows as landlords scale their portfolios or move further from their properties.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(