If you are thinking of converting the extra space in your home to a rental property, one of the first things you should do is protect it with the right insurance policy. Your initial thought would probably be to find a home insurance company, but it’s not what you need if you are looking for significant coverage for your rental homes. What you need is landlord insurance. Thus, it is important to understand the distinction between landlord insurance vs homeowners insurance, as each offers unique features and protections.

Normal or standard homeowners insurance policy offers coverage for your home (the physical structure) and personal items, but landlord insurance policies provide wider protection specifically focused on rental properties. In this article, we’ll talk about the crucial distinctions between landlord insurance and homeowners insurance, emphasizing the different protections each type provides.

What is Landlord Insurance?

Landlord insurance is a little similar to homeowner insurance except for several aspects that specially cater to rental property needs, such as handling an OKC storm damage claim for rental property. Also known as rental property insurance, it protects landlords from property damage, loss of rental income, and liability losses.

Additionally, landlords are allowed to avail of optional or additional coverage for rental homes that have been vacant for over 30 days, changes in the building code, rental renovation or construction, burglary, and mechanical problems in the heating or air conditioning systems.

Landlord insurance offers protection for properties that landlords leave in the rental home or building that their tenants can use. However, the policy does not reimburse or cover the tenants’ properties. This is why some landlords encourage their tenants to avail themselves of renter’s insurance.

According to Hippo Insurance, landlord insurance costs 25% more than the standard homeowner’s insurance, and Oklahoma has the highest landlord insurance rates.

Also, it is essential to know that if you plan to rent out your home or investment property for a limited period only or for a one-time special event (such as a conference or convention with a venue near your place), you do not need to get landlord insurance. This policy is intended only for landlords who plan to rent out their properties regularly for longer terms.

Types of Landlord Insurance Coverage

There are seven types of coverage provided to landlords.

Dwelling Coverage

This insurance coverage offers protection for structural damage resulting from vandalism, theft, fire, and even equipment or appliances that tenants break or destroy.

Personal Property Coverage

This insurance coverage offers protection for damages to personal items in the rental property (i.e., lights and other fixtures). However, it does not cover damage to items belonging to the tenants. If you plan to rent out a fully furnished rental home, you will need the protection that personal property coverage provides.

Liability Coverage

In case a tenant or guest gets injured within the rental premises, and the landlord is proven responsible for what happened, landlord insurance liability coverage will take care of the expenses.

Loss of Income/Loss of Rent/Fair Rental Value

This coverage protects rental that’s damaged and rendered unlivable, which means the landlord cannot collect rent from the tenant. The policy covers income loss for more or less 12 months or until the property is fixed and becomes livable and rentable again. However, the fair rental value does not cover the loss of income incurred because of tenant eviction or missed payments.

Legal Fee Coverage

Unlike homeowners insurance policy, landlord’s insurance provides coverage for legal counsel costs and legal fees resulting from potential lawsuits related to tenant issues or when the landlord has to go to court for tenants’ unpaid rent or neglected eviction notifications.

Flood Coverage

Flood coverage offers protection from water damage that results from rain, substandard plumbing, and broken pipes.

Acts of Nature Coverage

This coverage protects a landlord’s property from total loss or structural damage due to earthquakes, hurricanes, and tornadoes. Not all landlord insurance policies may offer this coverage, though.

What is Homeowners Insurance?

Homeowners insurance is a type of insurance policy that provides financial protection to homeowners in the event of damage or loss to their property. It typically covers the physical structure of the home, personal belongings, and liability for injuries or property damage caused by the homeowner or their family members.

Homeowners insurance typically includes coverage for additional living expenses. If your home becomes uninhabitable due to a covered loss, such as a fire or severe storm, this coverage assists with temporary living arrangements, including accommodations, meals, and other necessary expenses.

Homeowners insurance offers comprehensive protection for your property, personal belongings, and liability risks. By having this coverage, homeowners can have financial security and be better prepared to handle unexpected events or accidents that may occur within their homes or on their property.

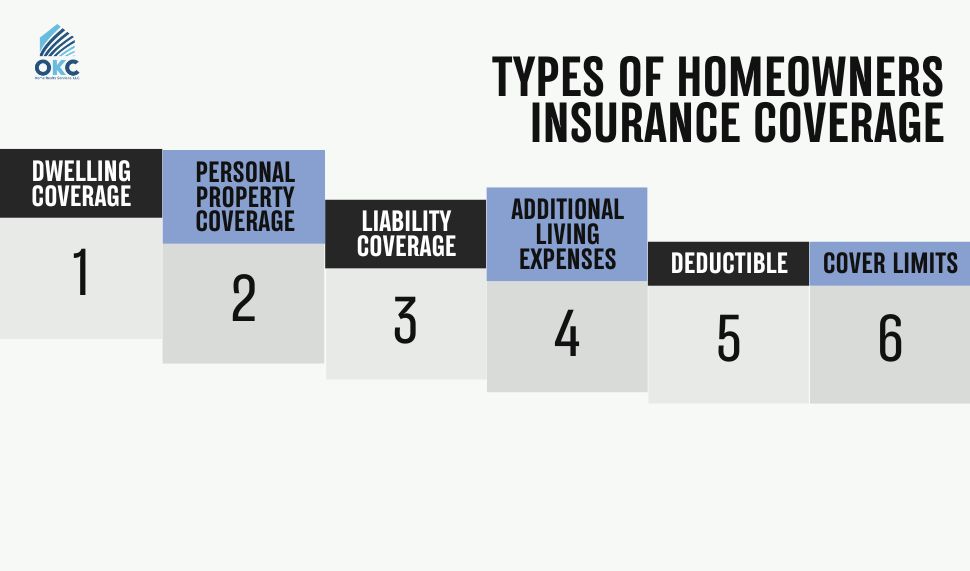

Types of Homeowners Insurance Coverage

Here are some coverages in Homeowners insurance:

Dwelling Coverage

This covers the cost of repairing/rebuilding your home in case of damage from covered perils like fire, storms, vandalism, or theft.

Personal Property Coverage

This protects your personal belongings such as furniture, appliances, clothing, and electronics from loss or damage. It usually includes coverage both outside and inside your home.

Liability Coverage

This provides protection if someone is injured on your property or if you accidentally damage something on someone else’s property. It can help cover legal expenses and potential settlements or judgments.

Additional Living Expenses

If your home becomes uninhabitable due to a covered event, this coverage will help you pay for temporary accommodations, meals, and other associated expenses while your home is being repaired or rebuilt.

Deductible

This is the amount you’re responsible for paying out of your pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but that also means that you’ll need to pay more upfront in the event of a claim.

Coverage Limits

Homeowners insurance policies have limits on how much they will pay for different types of losses. It’s important to review these limits and ensure that they adequately protect your home and belongings. You may need additional coverage, known as endorsements or riders, for high-value items like jewelry or artwork.

Key Differences Between Landlords Insurance vs Homeowners Insurance

As mentioned above, landlord insurance has some similarities with homeowner insurance, specifically in terms of protecting the building and other structures on the property. Both offer coverage for personal property and liabilities, but with variations.

Here are some important differences between Landlords Insurance and Homeowners Insurance:

- Homeowners insurance covers the primary residence of the owner, while landlords insurance covers their rental properties.

- Both homeowners insurance and landlords insurance include the coverage of the property’s structure and cost of damages repairs.

- Homeowners insurance covers personal property often while landlord insurance doesn’t cover your personal property.

- While landlords can opt for loss-of-rent coverage, homeowners insurance frequently includes loss-of-use coverage.

- Both homeowners insurance and landlords insurance can include coverage for medical and personal liability for guests who get injured on the property.

- Renters insurance policy is necessary since the landlord’s insurance doesn’t cover the tenant’s property.

- Homeowner’s insurance policies and landlord insurance policies do not cover certain types of damage, such as damage caused by pests or rodents.

How to Choose the Right Insurance?

Choosing the right insurance policy can be a intimidating, especially if you are new to the process. However, you can make an informed decision by understanding the key differences between homeowners insurance and landlord insurance.

If you own a property but use that property to rent out, then there is only one insurance to go for, and that is landlord insurance. As an important aspect for you, landlord insurance offers protection for the structure, loss of rental income, and liability.

On the other hand, if you are living in your primary residence, you must consider homeowners insurance. Homeowners insurance provides coverage for personal property, liability, and loss of use, which are all important considerations for you.

Ultimately, selecting the right insurance policy is largely depends on you and your requirements and situation. However, it’s a good idea to consult with an insurance agent or broker to determine the best course of action for you.

How Renters Insurance Protects Your Tenants?

Both landlord’s insurance and homeowners insurance do not cover your tenant’s personal belongings. That’s why, you want to make renters insurance a condition in the lease agreement. Renter’s Insurance provides valuable protection for tenants by safeguarding their personal belongings, offering liability coverage, and offering additional living expense coverage in case of unforeseen events. It ensures that the tenants have financial security and peace of mind while renting a property. Get to know does renters insurance covers displacement.

Get more information about rental property management services in Property Management OKC. You can fill up the form below or call us at 14052325800.

FAQs on Homeowners Insurance vs Landlords Insurance

Does a landlord need all types of coverage?

There is no rule or law about which types of coverage a landlord must get. The decision depends on what the landlord thinks is best for the property. It also depends on how much a landlord is willing to spend to protect his investment.

Is landlords insurance required by law?

Like homeowners insurance, landlord insurance is not required by law. However, getting one is essential if you want to protect your investment, which is your rental property. It is vital if you rent out multiple properties. Additionally, landlord insurance ensures landlords like your protection from financial loss.

Is landlords insurance policies tax deductible?

Since rental properties are considered businesses, your policy is regarded as a business expense. As such, you are allowed to deduct taxes for various and specific rental activities.

How vital is renter’s insurance?

Landlords should encourage their tenants to get renter’s insurance if they want to get the best out of their policy – and if they want additional protection, particularly when there is property damage or loss due to tenant neglect. For example: If a tenant left the stove on and the apartment caught fire, a portion of the damage will be covered by the tenant’s liability coverage, while the landlord’s policy will shoulder the other half. It is also essential to specify that renter’s insurance protects tenants’ personal property, something that landlord insurance does not offer. However, not all states allow landlords to require renters insurance. Other states require it only for tenants with steadier, higher salaries or income. Landlord’s insurance is vital for landlords like you. Set up a meeting with your insurance agent to know more about all the other advantages you can enjoy from getting a policy.

How can landlords reduce insurance premiums?

Landlords can reduce premiums by increasing deductibles, improving property security, or bundling policies with the same insurer.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(