Rental Property Cash Flow Overview

It is important to do the numbers when investing in real estate. Do not take the real estate agent’s word for it, no matter how tempting the deal may seem.

The most critical time to evaluate your numbers on any real estate is before you make an offer on a property.

There are two main pitfalls to avoid:

1. Not doing any real estate cash flow calculations at all. You need to crunch the numbers to understand the potential profitability of the investment property.

2. Working with inaccurate numbers can lead to flawed analysis. It’s common for real estate investors to underestimate repair costs or overestimate potential rental income. Hence, it results in unreliable cash flow projections.

This article will break down the monthly cash flow calculation for a rental property. It will walk you through the key factors, such as rental income, operating expenses, financing costs, and more. By the end, you’ll have a solid understanding of how to evaluate the cash flow potential of a real estate investment through rental property cash flow analysis.

Additionally, the article provides access to a free Rental Property Cash Flow Calculator, which can help you streamline the analysis process and ensure you have the right numbers to make informed investment decisions.

What is a Real Estate Cash Flow Statement?

A real estate cash flow statement refers to a financial statement that presents details about the amount of cash and cash equivalents of a real estate investment. It reports the changes in a company’s cash flow over a period of time.

A real estate cash flow statement helps you to understand the rental property cash flow analysis; the money your business is making and spending. Not only the statement includes where the money is coming from, and also how it is being spent.

Like the other financial statements, the real estate cash flow statement is also usually drawn up yearly, however, it can be drawn up more often if required.

Recommended Article: How to Finance Rental Property using OKC Mortgage Lenders?

Why is Cash Flow Statement Important?

A cash flow statement enables a real estate investor to use the information of the past cash flow statement of a company for projections of the future on which real estate investment decisions are based. It reveals any kind of changes in the balance sheet that explains the operating, investing, and financing activities of the company.

The cash flow statement provides insights into liquidity and stability, which is vital for the growth of any company. It shows the financial position of a company over a period of time. It provides detailed information concerning the cash-generating abilities of the company’s activities.

Calculating the cash flow will help a real estate investor reveal the quality of his/her rental income. This helps in making the right decision.

Understanding the company has some long-term debt, a Cash Flow Statement helps Oklahoma real estate investors to determine the possibility of payment. It helps to easily predict the uncertainty of future cash flows.

Engineering Your Rental Property Cash Flow

Your evaluation of the rental properties that you think you might buy is much like a structural engineer who is designing a bridge. An engineer relies upon certain mathematical formulas to tell him how to design the bridge. If he doesn’t perform those calculations, the bridge could weaken and fail at some time. That’s why the engineer must utilize the right structural properties for the materials that will be utilized to build the bridge. For an engineer designing a bridge, a mistake in math can be deadly.

You build a bridge with every property that you buy. Your aim is for that bridge to stand tall and strong financially once you open it up to traffic (i.e., lease it). The difference is that you’ll usually notice right away if there is a problem with the construction of your bridge. If you make a mistake, you may wind up with negative cash flow.

The real estate property that you buy must be capable of sustaining the cash flow you need to pay the expenses and debt service. Any weak section of the bridge weakens the entire bridge. The math will not be difficult as you will soon see.

What your Cash Flow Statement shows Investors

Your cash flow statement is the key report for real estate investors to interpret and analyze the overview of the firm. By running a statement for a given period you can get a clear breakdown of the key areas of cash movement in the business. At the same time, you’ll get to know how to calculate the cash flow of real estate property.

Investment Cash Flow

Investment expenses include investments that are generating revenues from non-current assets or securities that can’t be classed as cash equivalents. The expenses or transactions are related to a business’ investments in long-term assets.

Some examples of investing cash flows are payments for the purchase of land, buildings, equipment, and other investment assets and cash receipts from the sale of land, buildings, equipment, and other investment assets.

Operating Cash Flow

The operating expenses include property tax, hazard (fire) insurance, maintenance, property management, and vacancy.

Property Taxes: The property taxes are what you pay the county each year. You can get that total for any given property from your county assessor. Also, learn about rental property tax benefits for landlords.

Hazard Insurance: Your property must be covered by a good hazard insurance policy. Hazard insurance protects against fires, storm damage, and in some cases vandalism. Learn how to get an OKC storm damage claim.

Maintenance: In most cases, your landlord-tenant laws will hold you legally responsible for maintaining your rental property. That includes providing heat, plumbing, and electrical.

You can assume a maintenance figure of 5% of the rental amount for homes built within the last 15 years. For example, a house that is brick with a slab foundation and newer plumbing and electrical will need relatively less maintenance than other types of construction.

If the property is more than 15 years old but has many of its systems like heat and air and electrical updated, you can assume a maintenance figure of 10% of the rent.

Older properties that have not been updated may have maintenance costs as high as 15% to 20% of the rental amount. For example, a two-story frame house built in the 1920s will be high maintenance if it hasn’t had significant updates.

Vacancy: This is the percentage of time that a property sits vacant. A reasonable expectation is 10%. However, this figure can vary, depending on the rental property.

Mortgage Payment

The way to calculate how much your mortgage payment will be is to go to a site like Google and type into the search bar “loan calculator”. This will give you a way to enter the principal amount of your loan (total starting amount), the interest rate, and the term of the loan.

The interest rate and term of the loan will depend upon what type of financing you set up. If you are going to work with a bank, you might assume 6% interest with a 15-year note.

Real Estate Cash Flow Math for Dummies

The cash flow math is very simple. I’ll start with a simple example worked out by hand just to show you where the numbers come from. Then, I’ll introduce you to the Real Estate Cash Flow Calculator.

The cash flow (CF) is calculated as follows:

| Cash Flow (CF) = | Net Operating Income – Debt Service |

Net operating income is the net income less all operating expenses. To keep it simple, do the calculation on a monthly basis. So if any of your expenses like property taxes or insurance are listed on an annual basis, just divide by 12 to get the value for that expense per month.

Debt service is whatever your monthly mortgage payment is.

Example of Determining Cash Flow

A single-family home is refinanced with a 15-year note at 6% interest. The loan amount is $80,000. The property is rented for $997 per month. What is the cash flow?

Calculate Cash Flow. Projected income and expenses are as follows:

| Expenses | In $ |

| Rent | $997 |

| Property Tax | $124 |

| Hazard Insurance | $101 |

| Maintenance | $100 |

| Utilities | $0 |

| Vacancy (assumed 10%) | $100 |

| Property Management | $100 |

| Other | $0 |

| Total Expenses | $525 |

| Net Operating Income (Monthly) | $472 |

Negative cash flow is never great, two factors to consider are: Because the net operating income was $472, the cash flow is negative $203 per month. The monthly payment for the loan is $675.

- Over the life of the loan, there is an average debt reduction of $444 per month.

- The property will likely appreciate it.

- The rent is likely to go up.

But just to reiterate, the time to get the math right is before you do the deal. The owner of this property may have reconsidered had they done the math to find out the refinance would put them into a negative cash flow situation.

Rental Cash Flow Calculator

My business coach Martin Holland created a cash flow calculator for rental properties that he was nice enough to share with me, and allow me to give you access to download it. For more information about Martin Holland as a business coach, you go to https://www.annealbc.com/.

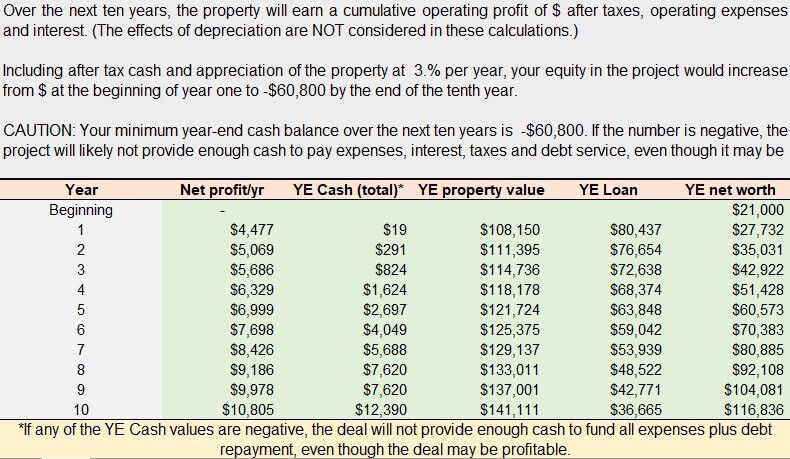

The beauty of this financial calculator is that it will provide you with a very detailed financial statement of the rental property investment projected out to ten years.

The rental property calculator is a very useful tool to evaluate the return on investment from a potential purchase. You can get the rental property calculator by following the link and filling out a simple form: Real Estate Cash Flow Calculator.

There is an example already keyed into the calculator. The example numbers are as follows:

[table id=2]

Entering Information into the rental financial calculator

Here is the screen you will see with the example information shown in the table above. When you want to enter your own information about a property you are evaluating, you will enter the information into the blue cells.

The financial real estate cash flow calculator is quite sophisticated. It calculates all these items:

- Owner’s cash position over their first ten years of ownership,

- Net profit year to year,

- Projected property value year to year,

- Loan balance year to year, and

- Net worth based on this one property year to year.

As you scroll down on the page, you will find a summary of the calculations which answer each of the above bullet points. Here is what you’ll see with the example data:

Based on the analysis at the end of the first year, the property is projected to have a positive flow (net profit $4,477 and year-ending cash $19). The property value is projected to be $108,150 (an increase of $3,150). The year-ending balance of the loan will be $80,437 (a principal reduction of $3,563). And finally, the projected net worth based on this one property is $27,732 (an increase of $2,732).

Additional Cash Flow Calculations to Know

There are three other common cash calculations used for rental property. They are the 1% Rule, the 50% Rule, and the Cash-on-Cash Return. These calculations will help you better understand the financial health and profitability of your rental property.

1% Rule

The 1% Rule states that the gross monthly rent should be at least 1% of your income property value. Here’s the formula:

Gross monthly rent÷Property value = 1% or more

$1,500 gross monthly rent / $150,000 property value = 0.01 or 1%

50% Rule

The 50% Rule states that a rental property’s net cash flow should be at least 50% or more of the gross rent less the mortgage payment (P&I). Here’s the formula:

Net cash flow = (Gross rent x 50%) – Mortgage P&I

($18,000 gross annual rent x 50%) – $6,000 mortgage P&I = $3,000 per year

Cash-on-Cash Return

The cash-on-cash return formula compares the cash invested in a rental property to the generated net cash flow. For example, the purchased property has a $35,000 down payment and the net cash flow is $3,000.

Cash-on-cash return = Net cash flow / Cash invested

$3,000 net cash flow / $35,000 down payment = 0.086 or 8.6%

Generally speaking, many investors believe that a higher cash-on-cash return on a rental property is better, provided that conservative leverage is being used.

These are definitely good numbers for this example.

Now that you have seen the example, key in the information for your potential rental property.

Remember, the time to get the math right is before you purchase the property.

Do the math to assure yourself that you will build a strong bridge that stands the test of time.

Here is a good article about why the Oklahoma City metro area rental real estate market is perfect for the long term.

If you are looking for trustworthy property management in Oklahoma City that can handle your rental properties and make steady profits, OKC Home Realty Services can be your right choice.

Author

Scott Nachatilo is an investor, property manager and owner of OKC Home Realty Services – one of the best property management companies in Oklahoma City. His mission is to help landlords and real estate investors to manage their property in Oklahoma.

(

(